LIFE INSURANCE

Öykü Penceresi Metni

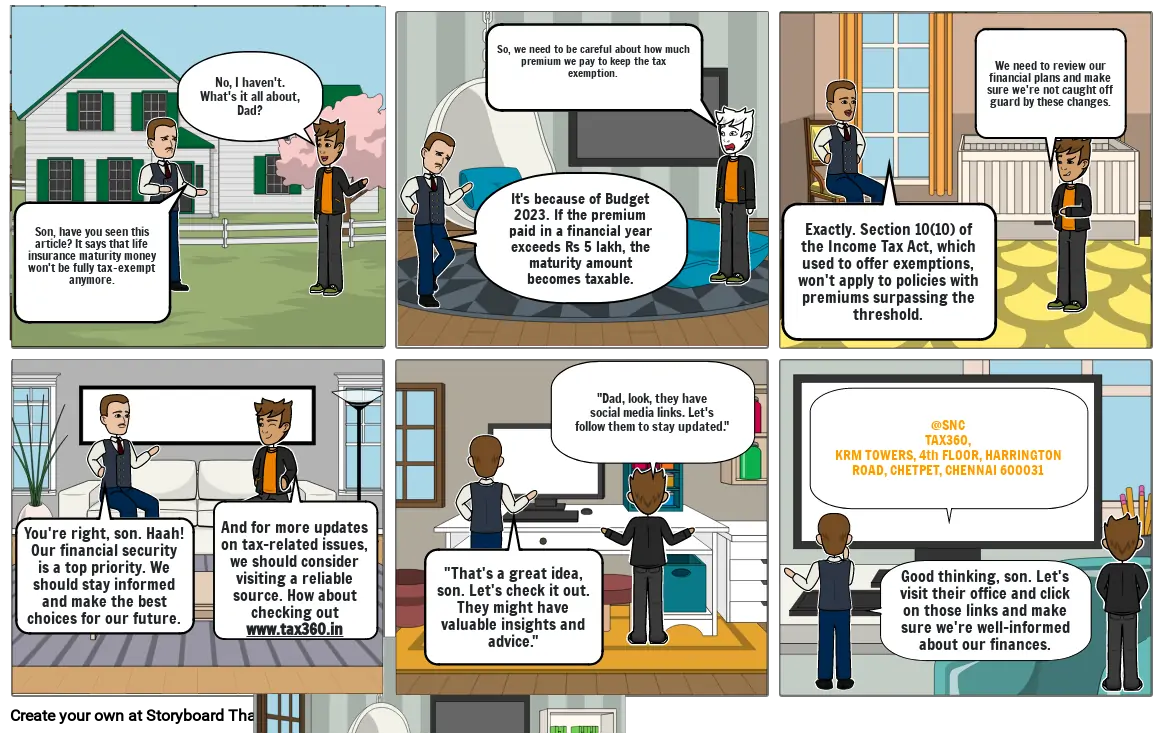

- Son, have you seen this article? It says that life insurance maturity money won't be fully tax-exempt anymore.

- No, I haven't. What's it all about, Dad?

- It's because of Budget 2023. If the premium paid in a financial year exceeds Rs 5 lakh, the maturity amount becomes taxable.

- So, we need to be careful about how much premium we pay to keep the tax exemption.

- Exactly. Section 10(10) of the Income Tax Act, which used to offer exemptions, won't apply to policies with premiums surpassing the threshold.

- We need to review our financial plans and make sure we're not caught off guard by these changes.

- You're right, son. Haah! Our financial security is a top priority. We should stay informed and make the best choices for our future.

- And for more updates on tax-related issues, we should consider visiting a reliable source. How about checking out www.tax360.in

- "That's a great idea, son. Let's check it out. They might have valuable insights and advice."

- "Dad, look, they have social media links. Let's follow them to stay updated."

- @SNCTAX360, KRM TOWERS, 4th FLOOR, HARRINGTON ROAD, CHETPET, CHENNAI 600031

- Good thinking, son. Let's visit their office and click on those links and make sure we're well-informed about our finances.

- ya sure

30 Milyondan Fazla Storyboard Oluşturuldu