EVOLUTION OF PHILIPPINE TAXATION

Storyboard Text

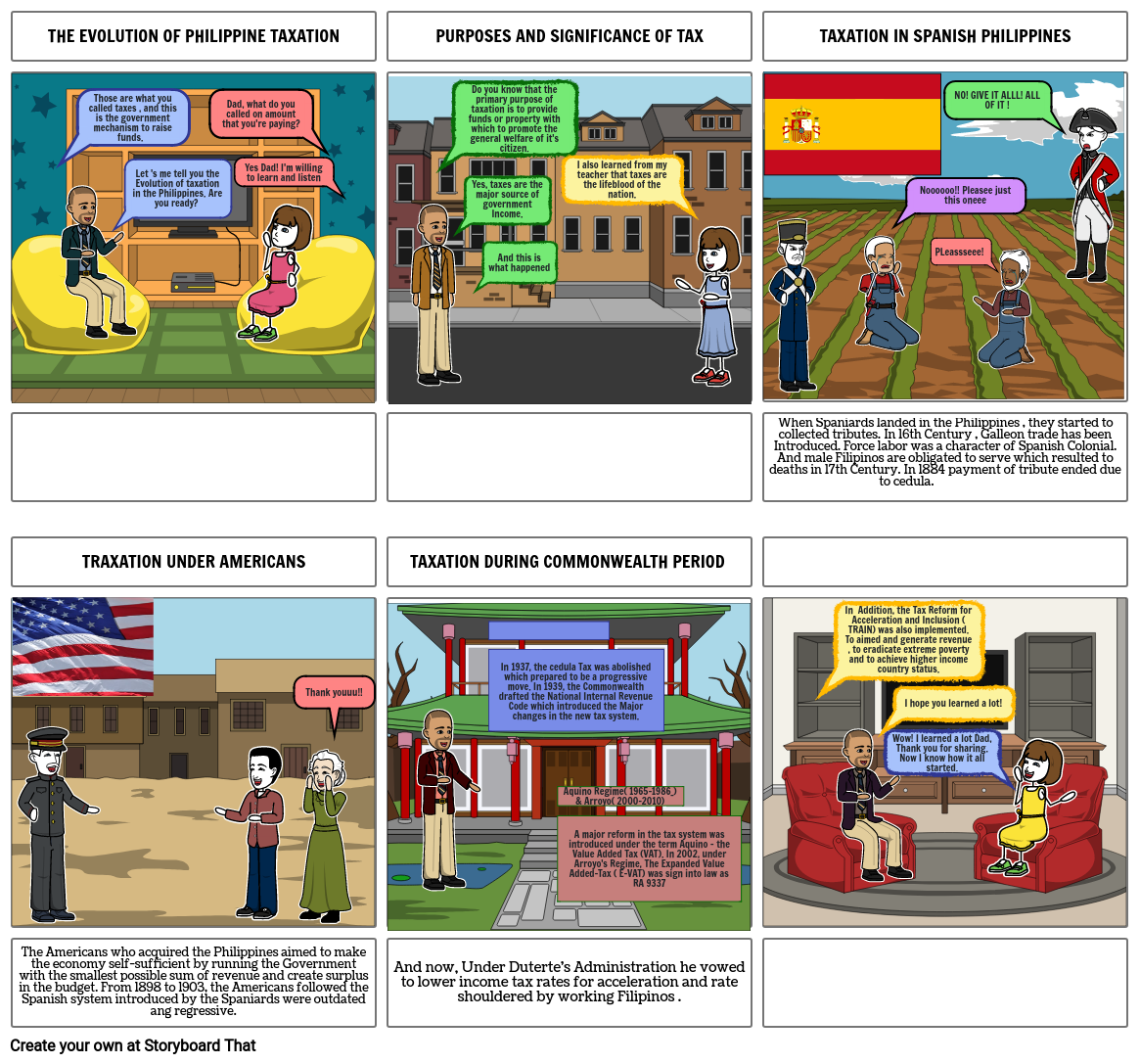

- THE EVOLUTION OF PHILIPPINE TAXATION

- Those are what you called taxes , and this is the government mechanism to raise funds.

- Let 's me tell you the Evolution of taxation in the Philippines. Are you ready?

- Dad, what do you called on amount that you're paying?

- Yes Dad! I'm willing to learn and listen

- PURPOSES AND SIGNIFICANCE OF TAX

- Do you know that the primary purpose of taxation is to provide funds or property with which to promote the general welfare of it's citizen.

- Yes, taxes are the major source of government Income.

- And this is what happened

- I also learned from my teacher that taxes are the lifeblood of the nation.

- TAXATION IN SPANISH PHILIPPINES

- Noooooo!! Pleasee just this oneee

- PLeassseee!

- NO! GIVE IT ALLL! ALL OF IT !

- TRAXATION UNDER AMERICANS

- Thank youuu!!

- TAXATION DURING COMMONWEALTH PERIOD

- In 1937, the cedula Tax was abolished which prepared to be a progressive move. In 1939, the Commonwealth drafted the National Internal Revenue Code which introduced the Major changes in the new tax system.

- When Spaniards landed in the Philippines , they started to collected tributes. In 16th Century , Galleon trade has been Introduced. Force labor was a character of Spanish Colonial. And male Filipinos are obligated to serve which resulted to deaths in 17th Century. In 1884 payment of tribute ended due to cedula.

- In Addition, the Tax Reform for Acceleration and Inclusion ( TRAIN) was also implemented. To aimed and generate revenue , to eradicate extreme poverty and to achieve higher income country status.

- The Americans who acquired the Philippines aimed to make the economy self-sufficient by running the Government with the smallest possible sum of revenue and create surplus in the budget. From 1898 to 1903, the Americans followed the Spanish system introduced by the Spaniards were outdated ang regressive.

- And now, Under Duterte's Administration he vowed to lower income tax rates for acceleration and rate shouldered by working Filipinos .

- Aquino Regime( 1965-1986_) & Arroyo( 2000-2010) A major reform in the tax system was introduced under the term Aquino - the Value Added Tax (VAT). In 2002, under Arroyo's Regime, The Expanded Value Added-Tax ( E-VAT) was sign into law as RA 9337

- I hope you learned a lot!

- Wow! I learned a lot Dad, Thank you for sharing. Now I know how it all started.

Over 30 Million Storyboards Created