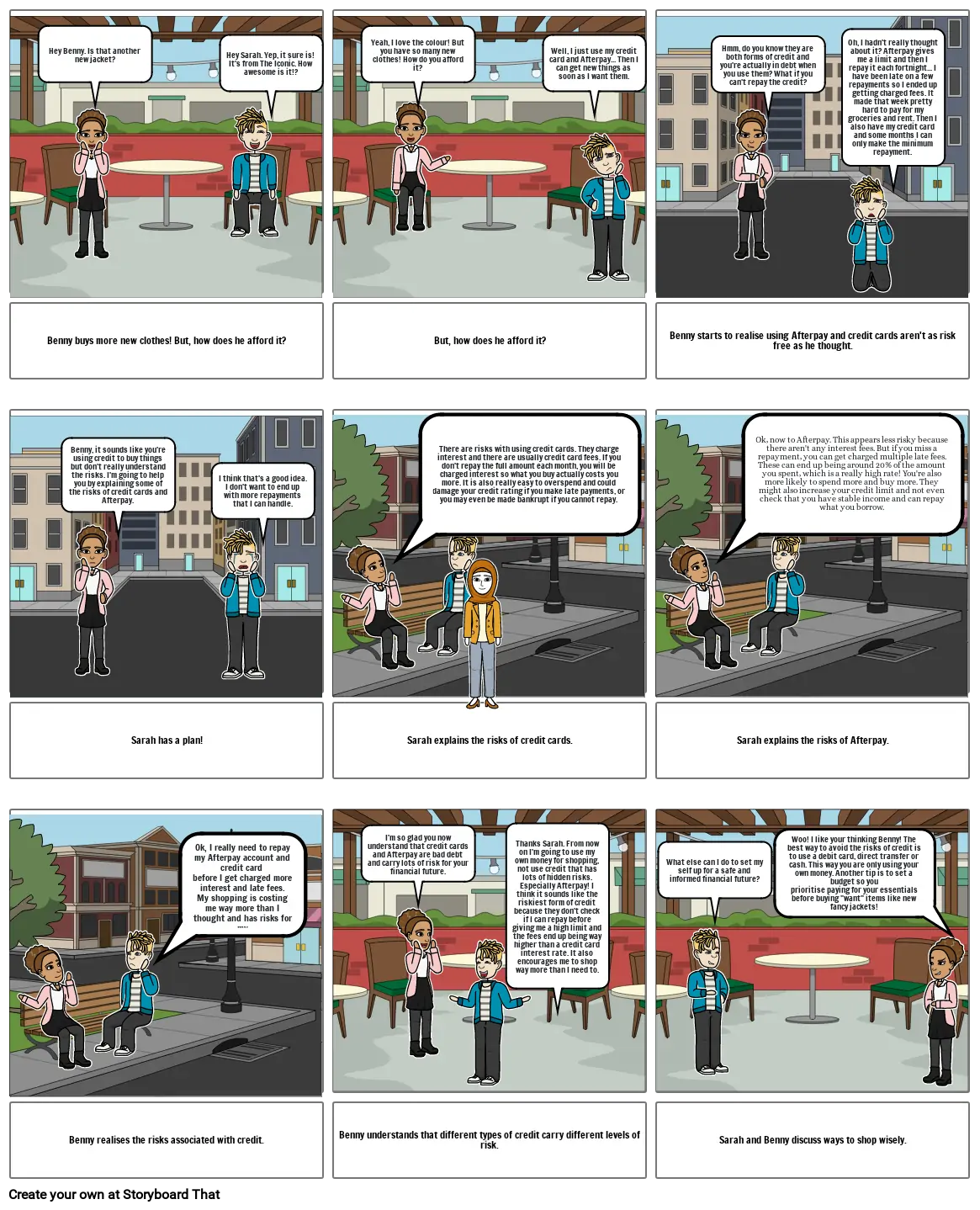

Financial Risks

Storyboard Text

- Hey Benny. Is that another new jacket?

- Hey Sarah. Yep, it sure is! It's from The Iconic. How awesome is it!?

- Yeah, I love the colour! But you have so many new clothes! How do you afford it?

- Well, I just use my credit card and Afterpay... Then I can get new things as soon as I want them.

- Hmm, do you know they are both forms of credit and you're actually in debt when you use them? What if you can't repay the credit?

- Oh, I hadn't really thought about it? Afterpay gives me a limit and then I repay it each fortnight... I have been late on a few repayments so I ended up getting charged fees. It made that week pretty hard to pay for my groceries and rent. Then I also have my credit card and some months I can only make the minimum repayment.

- Benny buys more new clothes! But, how does he afford it?

- Benny, it sounds like you're using credit to buy things but don't really understand the risks. I'm going to help you by explaining some of the risks of credit cards and Afterpay.

- I think that's a good idea. I don't want to end up with more repayments that I can handle.

- But, how does he afford it?

- There are risks with using credit cards. They charge interest and there are usually credit card fees. If you don't repay the full amount each month, you will be charged interest so what you buy actually costs you more. It is also really easy to overspend and could damage your credit rating if you make late payments, or you may even be made bankrupt if you cannot repay.

- Benny starts to realise using Afterpay and credit cards aren't as risk free as he thought.

- Ok, now to Afterpay. This appears less risky because there aren't any interest fees. But if you miss a repayment, you can get charged multiple late fees. These can end up being around 20% of the amount you spent, which is a really high rate! You're also more likely to spend more and buy more. They might also increase your credit limit and not even check that you have stable income and can repay what you borrow.

- Sarah has a plan!

- Ok, I really need to repay my Afterpay account and credit card before I get charged more interest and late fees. My shopping is costing me way more than I thought and has risks for my financial future.

- Sarah explains the risks of credit cards.

- I'm so glad you now understand that credit cards and Afterpay are bad debt and carry lots of risk for your financial future.

- Thanks Sarah. From now on I'm going to use my own money for shopping, not use credit that has lots of hidden risks. Especially Afterpay! I think it sounds like the riskiest form of credit because they don't check if I can repay before giving me a high limit and the fees end up being way higher than a credit card interest rate. It also encourages me to shop way more than I need to.

- Sarah explains the risks of Afterpay.

- What else can I do to set my self up for a safe and informed financial future?

- Woo! I like your thinking Benny! The best way to avoid the risks of credit is to use a debit card, direct transfer or cash. This way you are only using your own money. Another tip is to set a budget so you prioritise paying for your essentials before buying "want" items like new fancy jackets!

- Benny realises the risks associated with credit.

- Benny understands that different types of credit carry different levels of risk.

- Sarah and Benny discuss ways to shop wisely.

Over 30 Million Storyboards Created