Jill and Sue's Progressive Income Taxes

Storyboard Text

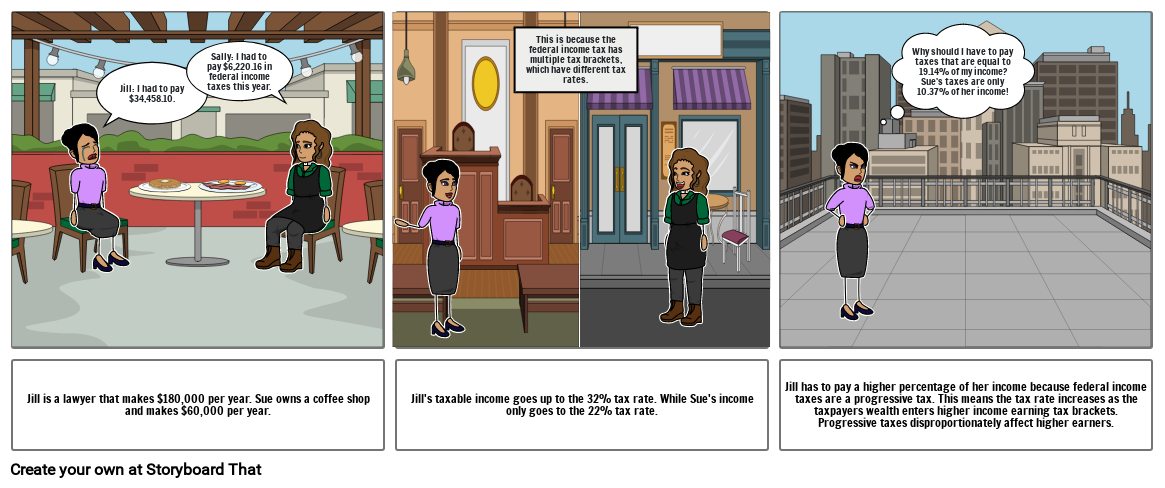

- Jill: I had to pay $34,458.10.

- Sally: I had to pay $6,220.16 in federal income taxes this year.

- This is because the federal income tax has multiple tax brackets, which have different tax rates.

- Why should I have to pay taxes that are equal to 19.14% of my income? Sue's taxes are only 10.37% of her income!

- Jill is a lawyer that makes $180,000 per year. Sue owns a coffee shop and makes $60,000 per year.

- Jill's taxable income goes up to the 32% tax rate. While Sue's income only goes to the 22% tax rate.

- Jill has to pay a higher percentage of her income because federal income taxes are a progressive tax. This means the tax rate increases as the taxpayers wealth enters higher income earning tax brackets. Progressive taxes disproportionately affect higher earners.

Over 30 Million Storyboards Created