Unknown Story

Snemalna Knjiga Besedilo

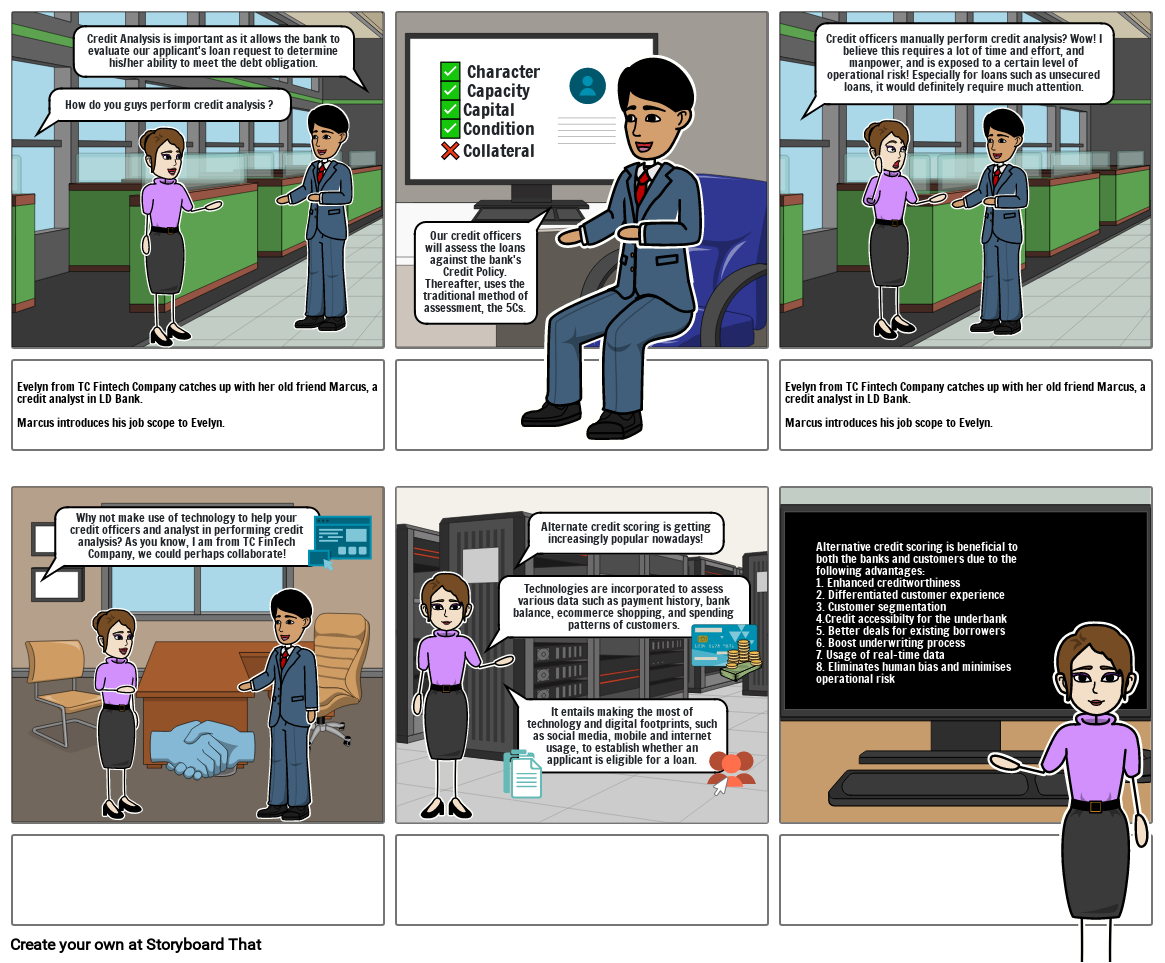

- How do you guys perform credit analysis ?

- Credit Analysis is important as it allows the bank to evaluate our applicant's loan request to determine his/her ability to meet the debt obligation.

- Our credit officers will assess the loans against the bank's Credit Policy. Thereafter, uses the traditional method of assessment, the 5Cs.

- ✅ Character✅ Capacity✅Capital✅Condition❌Collateral

- Credit officers manually perform credit analysis? Wow! I believe this requires a lot of time and effort, and manpower, and is exposed to a certain level of operational risk! Especially for loans such as unsecured loans, it would definitely require much attention.

- Evelyn from TC Fintech Company catches up with her old friend Marcus, a credit analyst in LD Bank. Marcus introduces his job scope to Evelyn.

- Why not make use of technology to help your credit officers and analyst in performing credit analysis? As you know, I am from TC FinTech Company, we could perhaps collaborate!

- Technologies are incorporated to assess various data such as payment history, bank balance, ecommerce shopping, and spending patterns of customers.

- It entails making the most of technology and digital footprints, such as social media, mobile and internet usage, to establish whether an applicant is eligible for a loan.

- Alternate credit scoring is getting increasingly popular nowadays!

- Evelyn from TC Fintech Company catches up with her old friend Marcus, a credit analyst in LD Bank. Marcus introduces his job scope to Evelyn.

- Alternative credit scoring is beneficial to both the banks and customers due to the following advantages:1. Enhanced creditworthiness2. Differentiated customer experience3. Customer segmentation4.Credit accessibilty for the underbank5. Better deals for existing borrowers6. Boost underwriting process7. Usage of real-time data8. Eliminates human bias and minimises operational risk

Ustvarjenih več kot 30 milijonov snemalnih knjig

Brez Prenosov, Brez Kreditne Kartice in Brez Prijave!