Unknown Story

Snemalna Knjiga Besedilo

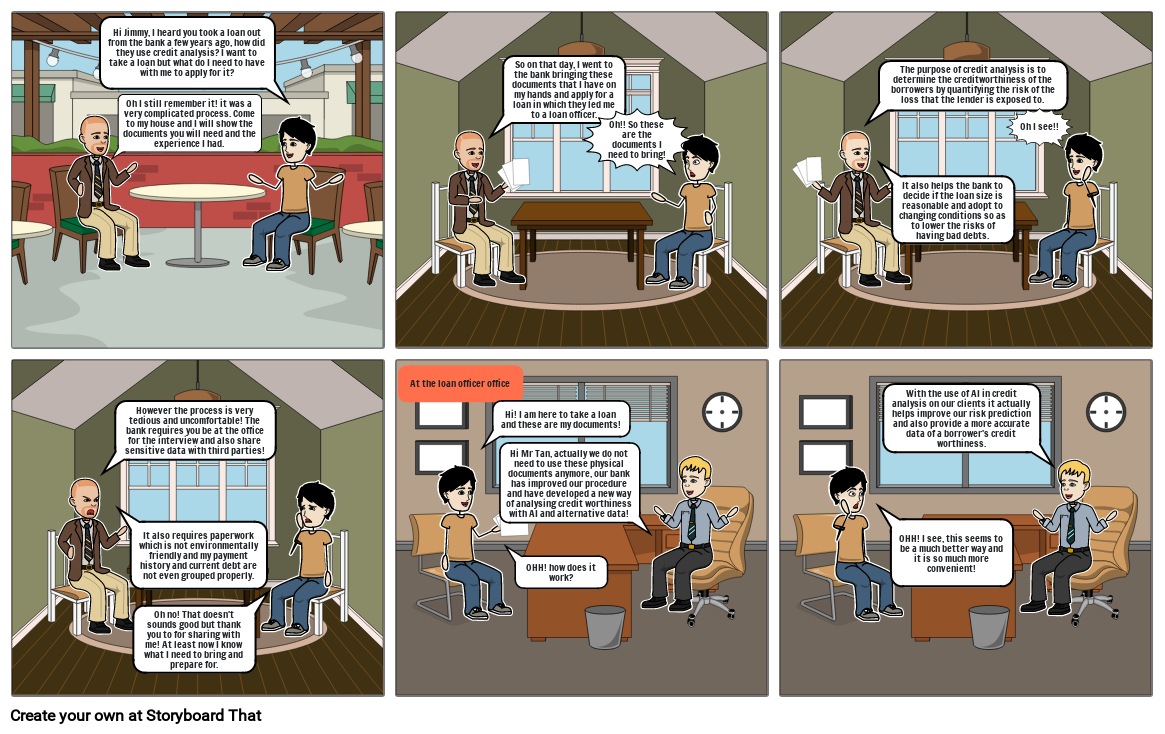

- Hi Jimmy, I heard you took a loan out from the bank a few years ago, how did they use credit analysis? I want to take a loan but what do I need to have with me to apply for it?

- Oh I still remember it! it was a very complicated process. Come to my house and I will show the documents you will need and the experience I had.

- So on that day, I went to the bank bringing these documents that I have on my hands and apply for a loan in which they led me to a loan officer.

- Oh!! So these are the documents I need to bring!

- The purpose of credit analysis is to determine the creditworthiness of the borrowers by quantifying the risk of the loss that the lender is exposed to.

- It also helps the bank to decide if the loan size is reasonable and adopt to changing conditions so as to lower the risks of having bad debts.

- Oh I see!!

- However the process is very tedious and uncomfortable! The bank requires you be at the office for the interview and also share sensitive data with third parties!

- It also requires paperwork which is not environmentally friendly and my payment history and current debt are not even grouped properly.

- Oh no! That doesn't sounds good but thank you to for sharing with me! At least now I know what I need to bring and prepare for.

- At the loan officer office

- Hi! I am here to take a loan and these are my documents!

- Hi Mr Tan, actually we do not need to use these physical documents anymore, our bank has improved our procedure and have developed a new way of analysing credit worthiness with AI and alternative data!

- OHH! how does it work?

- OHH! I see, this seems to be a much better way and it is so much more convenient!

- With the use of AI in credit analysis on our clients it actually helps improve our risk prediction and also provide a more accurate data of a borrower's credit worthiness.

Ustvarjenih več kot 30 milijonov snemalnih knjig