evolution of taxation storyboard by abreil

Text z Príbehu

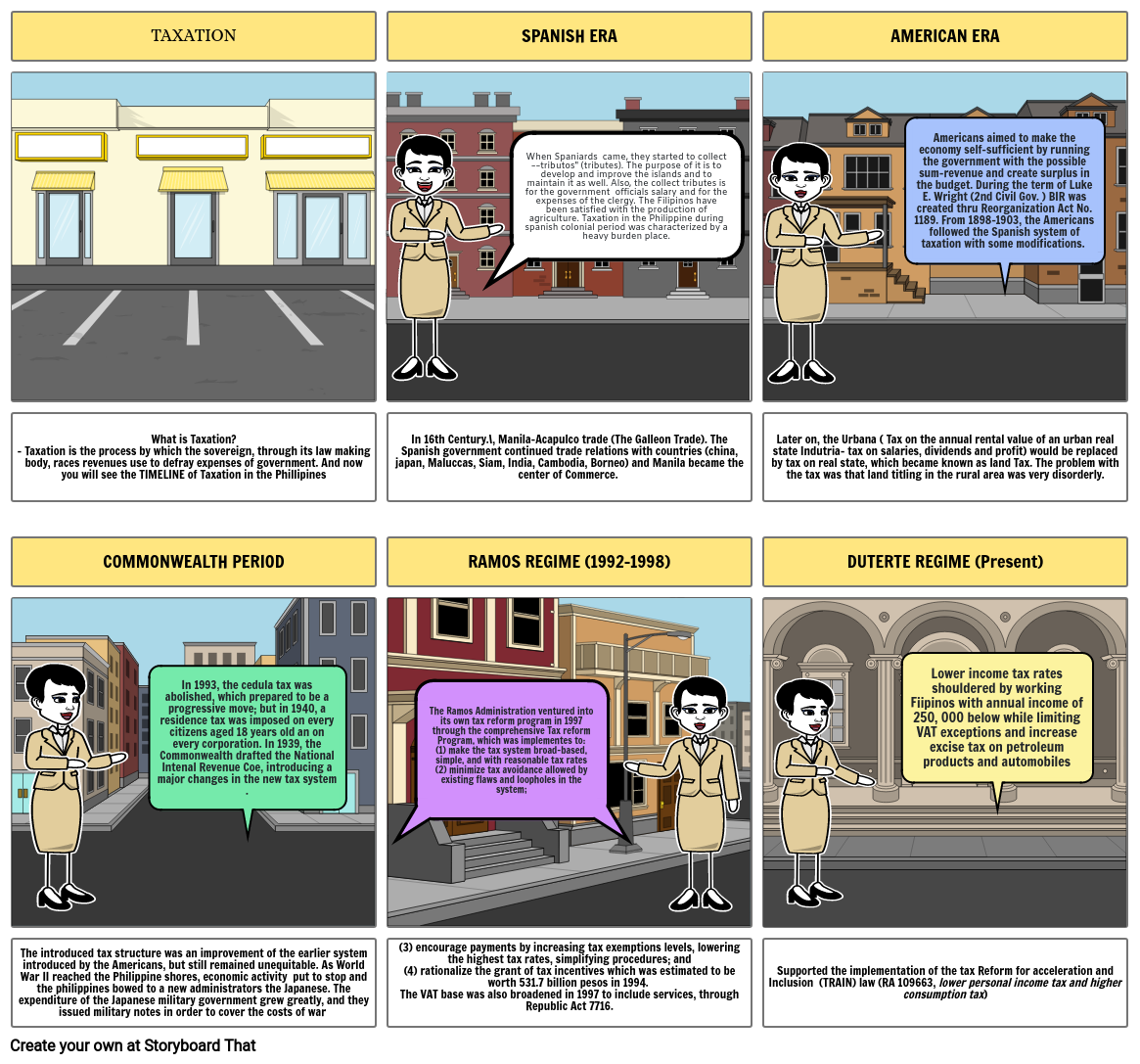

- TAXATION

- SPANISH ERA

- When Spaniards came, they started to collect ~~tributos" (tributes). The purpose of it is to develop and improve the islands and to maintain it as well. Also, the collect tributes is for the government officials salary and for the expenses of the clergy. The Filipinos have been satisfied with the production of agriculture. Taxation in the Philippine during spanish colonial period was characterized by a heavy burden place.

- AMERICAN ERA

- Americans aimed to make the economy self-sufficient by running the government with the possible sum-revenue and create surplus in the budget. During the term of Luke E. Wright (2nd Civil Gov. ) BIR was created thru Reorganization Act No. 1189. From 1898-1903, the Americans followed the Spanish system of taxation with some modifications.

- What is Taxation? - Taxation is the process by which the sovereign, through its law making body, races revenues use to defray expenses of government. And now you will see the TIMELINE of Taxation in the Phillipines

- COMMONWEALTH PERIOD

- In 1993, the cedula tax was abolished, which prepared to be a progressive move; but in 1940, a residence tax was imposed on every citizens aged 18 years old an on every corporation. In 1939, the Commonwealth drafted the National Intenal Revenue Coe, introducing a major changes in the new tax system .

- In 16th Century.\, Manila-Acapulco trade (The Galleon Trade). The Spanish government continued trade relations with countries (china, japan, Maluccas, Siam, India, Cambodia, Borneo) and Manila became the center of Commerce.

- RAMOS REGIME (1992-1998)

- The Ramos Administration ventured into its own tax reform program in 1997 through the comprehensive Tax reform Program, which was implementes to:(1) make the tax system broad-based, simple, and with reasonable tax rates(2) minimize tax avoidance allowed by existing flaws and loopholes in the system;

- Later on, the Urbana ( Tax on the annual rental value of an urban real state Indutria- tax on salaries, dividends and profit) would be replaced by tax on real state, which became known as land Tax. The problem with the tax was that land titling in the rural area was very disorderly.

- DUTERTE REGIME (Present)

- Lower income tax rates shouldered by working Fiipinos with annual income of 250, 000 below while limiting VAT exceptions and increase excise tax on petroleum products and automobiles

- The introduced tax structure was an improvement of the earlier system introduced by the Americans, but still remained unequitable. As World War II reached the Philippine shores, economic activity put to stop and the philippines bowed to a new administrators the Japanese. The expenditure of the Japanese military government grew greatly, and they issued military notes in order to cover the costs of war

- (3) encourage payments by increasing tax exemptions levels, lowering the highest tax rates, simplifying procedures; and(4) rationalize the grant of tax incentives which was estimated to be worth 531.7 billion pesos in 1994. The VAT base was also broadened in 1997 to include services, through Republic Act 7716.

- Supported the implementation of the tax Reform for acceleration and Inclusion (TRAIN) law (RA 109663, lower personal income tax and higher consumption tax)

Bolo vytvorených viac ako 30 miliónov storyboardov