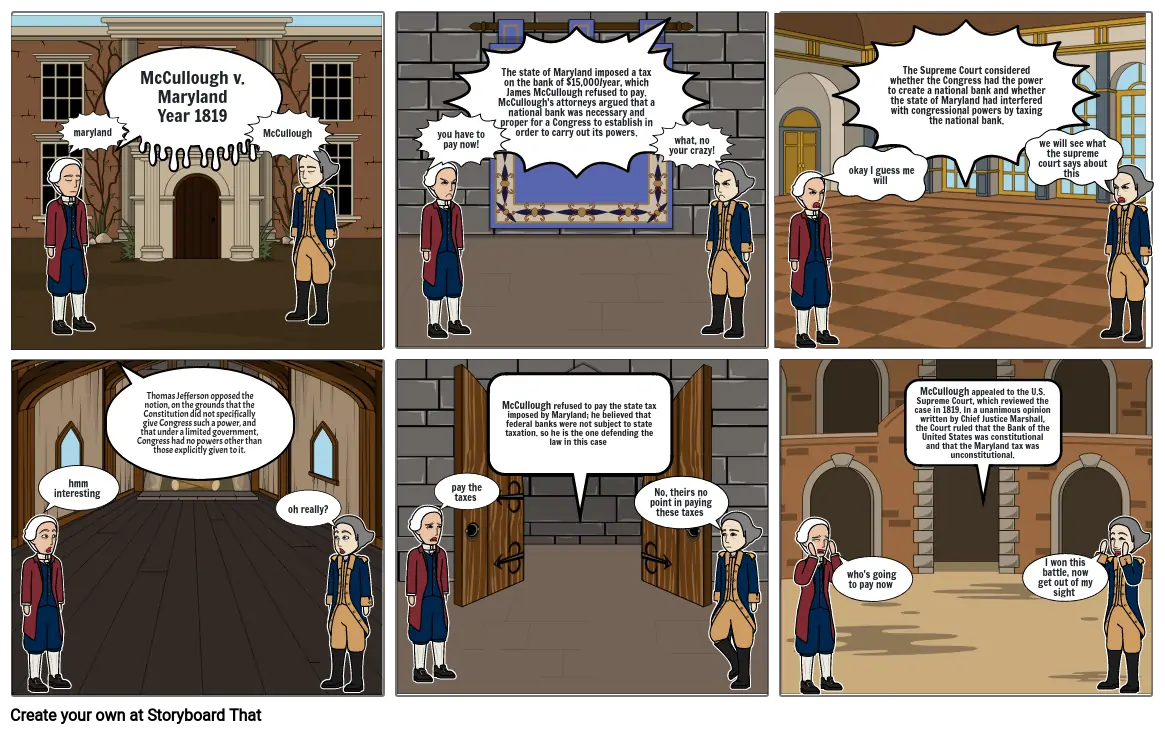

McCulloch v. Maryland

Storyboard Text

- maryland

- McCullough v. MarylandYear 1819

- McCullough

- you have to pay now!

- The state of Maryland imposed a taxon the bank of $15,000/year, which James McCullough refused to pay.McCullough's attorneys argued that a national bank was necessary and proper for a Congress to establish in order to carry out its powers.

- what, no your crazy!

- okay I guess me will

- The Supreme Court considered whether the Congress had the power to create a national bank and whether the state of Maryland had interfered with congressional powers by taxing the national bank.

- we will see what the supreme court says about this

- hmm interesting

- Thomas Jefferson opposed the notion, on the grounds that the Constitution did not specifically give Congress such a power, and that under a limited government, Congress had no powers other than those explicitly given to it.

- oh really?

- pay the taxes

- McCullough refused to pay the state tax imposed by Maryland; he believed that federal banks were not subject to state taxation. so he is the one defending the law in this case

- No, theirs no point in paying these taxes

- who's going to pay now

- McCullough appealed to the U.S. Supreme Court, which reviewed the case in 1819. In a unanimous opinion written by Chief Justice Marshall, the Court ruled that the Bank of the United States was constitutional and that the Maryland tax was unconstitutional.

- I won this battle, now get out of my sight

Peste 30 de milioane de Storyboard-uri create