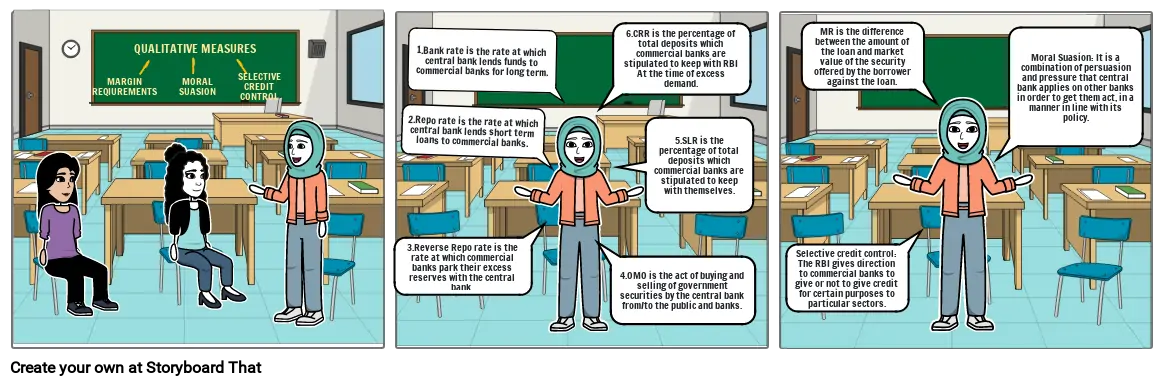

INSTRUMENTS OF CREDIT CONTROL

Storyboard Text

- MARGIN REQIUREMENTS

- QUALITATIVE MEASURES

- MORAL SUASION

- SELECTIVE CREDIT CONTROL

- 3.Reverse Repo rate is the rate at which commercial banks park their excess reserves with the central bank.

- 2.Repo rate is the rate at which central bank lends short term loans to commercial banks.

- 1.Bank rate is the rate at which central bank lends funds to commercial banks for long term.

- 4.OMO is the act of buying and selling of government securities by the central bank from/to the public and banks.

- 6.CRR is the percentage of total deposits which commercial banks are stipulated to keep with RBI At the time of excess demand.

- 5.SLR is the percentage of total deposits which commercial banks are stipulated to keep with themselves.

- Selective credit control: The RBI gives direction to commercial banks to give or not to give credit for certain purposes to particular sectors.

- MR is the difference between the amount of the loan and market value of the security offered by the borrower against the loan.

- Moral Suasion: It is a combination of persuasion and pressure that central bank applies on other banks in order to get them act, in a manner in line with its policy.

Peste 30 de milioane de Storyboard-uri create