Great depression

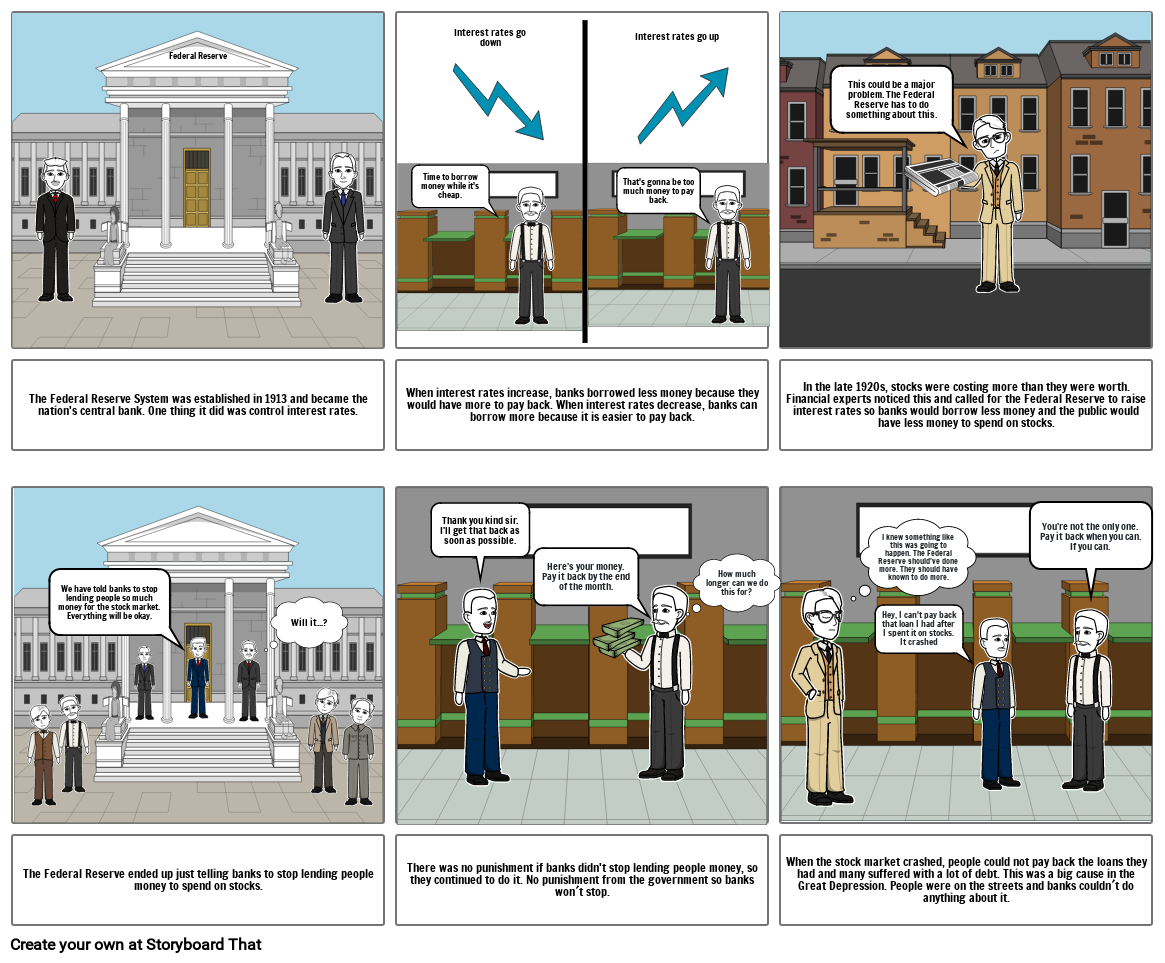

The Federal Reserve System was established in 1913 and became the nation's central bank. One thing it did was control interest rates.

When interest rates increase, banks borrowed less money because they would have more to pay back. When interest rates decrease, banks can borrow more because it is easier to pay back.

In the late 1920s, stocks were costing more than they were worth. Financial experts noticed this and called for the Federal Reserve to raise interest rates so banks would borrow less money and the public would have less money to spend on stocks.

The Federal Reserve ended up just telling banks to stop lending people money to spend on stocks.

There was no punishment if banks didn't stop lending people money, so they continued to do it. No punishment from the government so banks won´t stop.

When the stock market crashed, people could not pay back the loans they had and many suffered with a lot of debt. This was a big cause in the Great Depression. People were on the streets and banks couldn´t do anything about it.

Federal Reserve

Interest rates go down

Interest rates go up

Time to borrow money while it's cheap.

That's gonna be too much money to pay back.

This could be a major problem. The Federal Reserve has to do something about this.

We have told banks to stop lending people so much money for the stock market. Everything will be okay.

Will it...?

Here's your money. Pay it back by the end of the month.

How much longer can we do this for?

Thank you kind sir. I'll get that back as soon as possible.

I knew something like this was going to happen. The Federal Reserve should've done more. They should have known to do more.

Hey, I can't pay back that loan I had after I spent it on stocks. It crashed

You're not the only one. Pay it back when you can. If you can.

The Federal Reserve System was established in 1913 and became the nation's central bank. One thing it did was control interest rates.

When interest rates increase, banks borrowed less money because they would have more to pay back. When interest rates decrease, banks can borrow more because it is easier to pay back.

In the late 1920s, stocks were costing more than they were worth. Financial experts noticed this and called for the Federal Reserve to raise interest rates so banks would borrow less money and the public would have less money to spend on stocks.

The Federal Reserve ended up just telling banks to stop lending people money to spend on stocks.

There was no punishment if banks didn't stop lending people money, so they continued to do it. No punishment from the government so banks won´t stop.

When the stock market crashed, people could not pay back the loans they had and many suffered with a lot of debt. This was a big cause in the Great Depression. People were on the streets and banks couldn´t do anything about it.

Federal Reserve

Interest rates go down

Interest rates go up

Time to borrow money while it's cheap.

That's gonna be too much money to pay back.

This could be a major problem. The Federal Reserve has to do something about this.

We have told banks to stop lending people so much money for the stock market. Everything will be okay.

Will it...?

Here's your money. Pay it back by the end of the month.

How much longer can we do this for?

Thank you kind sir. I'll get that back as soon as possible.

I knew something like this was going to happen. The Federal Reserve should've done more. They should have known to do more.

Hey, I can't pay back that loan I had after I spent it on stocks. It crashed

You're not the only one. Pay it back when you can. If you can.

The Federal Reserve System was established in 1913 and became the nation's central bank. One thing it did was control interest rates.

When interest rates increase, banks borrowed less money because they would have more to pay back. When interest rates decrease, banks can borrow more because it is easier to pay back.

In the late 1920s, stocks were costing more than they were worth. Financial experts noticed this and called for the Federal Reserve to raise interest rates so banks would borrow less money and the public would have less money to spend on stocks.

The Federal Reserve ended up just telling banks to stop lending people money to spend on stocks.

There was no punishment if banks didn't stop lending people money, so they continued to do it. No punishment from the government so banks won´t stop.

When the stock market crashed, people could not pay back the loans they had and many suffered with a lot of debt. This was a big cause in the Great Depression. People were on the streets and banks couldn´t do anything about it.

Federal Reserve

Interest rates go down

Interest rates go up

Time to borrow money while it's cheap.

That's gonna be too much money to pay back.

This could be a major problem. The Federal Reserve has to do something about this.

We have told banks to stop lending people so much money for the stock market. Everything will be okay.

Will it...?

Here's your money. Pay it back by the end of the month.

How much longer can we do this for?

Thank you kind sir. I'll get that back as soon as possible.

I knew something like this was going to happen. The Federal Reserve should've done more. They should have known to do more.

Hey, I can't pay back that loan I had after I spent it on stocks. It crashed

You're not the only one. Pay it back when you can. If you can.

The Federal Reserve System was established in 1913 and became the nation's central bank. One thing it did was control interest rates.

When interest rates increase, banks borrowed less money because they would have more to pay back. When interest rates decrease, banks can borrow more because it is easier to pay back.

In the late 1920s, stocks were costing more than they were worth. Financial experts noticed this and called for the Federal Reserve to raise interest rates so banks would borrow less money and the public would have less money to spend on stocks.

The Federal Reserve ended up just telling banks to stop lending people money to spend on stocks.

There was no punishment if banks didn't stop lending people money, so they continued to do it. No punishment from the government so banks won´t stop.

When the stock market crashed, people could not pay back the loans they had and many suffered with a lot of debt. This was a big cause in the Great Depression. People were on the streets and banks couldn´t do anything about it.

Federal Reserve

Interest rates go down

Interest rates go up

Time to borrow money while it's cheap.

That's gonna be too much money to pay back.

This could be a major problem. The Federal Reserve has to do something about this.

We have told banks to stop lending people so much money for the stock market. Everything will be okay.

Will it...?

Here's your money. Pay it back by the end of the month.

How much longer can we do this for?

Thank you kind sir. I'll get that back as soon as possible.

I knew something like this was going to happen. The Federal Reserve should've done more. They should have known to do more.

Hey, I can't pay back that loan I had after I spent it on stocks. It crashed

You're not the only one. Pay it back when you can. If you can.

The Federal Reserve System was established in 1913 and became the nation's central bank. One thing it did was control interest rates.

When interest rates increase, banks borrowed less money because they would have more to pay back. When interest rates decrease, banks can borrow more because it is easier to pay back.

In the late 1920s, stocks were costing more than they were worth. Financial experts noticed this and called for the Federal Reserve to raise interest rates so banks would borrow less money and the public would have less money to spend on stocks.

The Federal Reserve ended up just telling banks to stop lending people money to spend on stocks.

There was no punishment if banks didn't stop lending people money, so they continued to do it. No punishment from the government so banks won´t stop.

When the stock market crashed, people could not pay back the loans they had and many suffered with a lot of debt. This was a big cause in the Great Depression. People were on the streets and banks couldn´t do anything about it.

Federal Reserve

Interest rates go down

Interest rates go up

Time to borrow money while it's cheap.

That's gonna be too much money to pay back.

This could be a major problem. The Federal Reserve has to do something about this.

We have told banks to stop lending people so much money for the stock market. Everything will be okay.

Will it...?

Here's your money. Pay it back by the end of the month.

How much longer can we do this for?

Thank you kind sir. I'll get that back as soon as possible.

I knew something like this was going to happen. The Federal Reserve should've done more. They should have known to do more.

Hey, I can't pay back that loan I had after I spent it on stocks. It crashed

You're not the only one. Pay it back when you can. If you can.

The Federal Reserve System was established in 1913 and became the nation's central bank. One thing it did was control interest rates.

When interest rates increase, banks borrowed less money because they would have more to pay back. When interest rates decrease, banks can borrow more because it is easier to pay back.

In the late 1920s, stocks were costing more than they were worth. Financial experts noticed this and called for the Federal Reserve to raise interest rates so banks would borrow less money and the public would have less money to spend on stocks.

The Federal Reserve ended up just telling banks to stop lending people money to spend on stocks.

There was no punishment if banks didn't stop lending people money, so they continued to do it. No punishment from the government so banks won´t stop.

When the stock market crashed, people could not pay back the loans they had and many suffered with a lot of debt. This was a big cause in the Great Depression. People were on the streets and banks couldn´t do anything about it.

Federal Reserve

Interest rates go down

Interest rates go up

Time to borrow money while it's cheap.

That's gonna be too much money to pay back.

This could be a major problem. The Federal Reserve has to do something about this.

We have told banks to stop lending people so much money for the stock market. Everything will be okay.

Will it...?

Here's your money. Pay it back by the end of the month.

How much longer can we do this for?

Thank you kind sir. I'll get that back as soon as possible.

I knew something like this was going to happen. The Federal Reserve should've done more. They should have known to do more.

Hey, I can't pay back that loan I had after I spent it on stocks. It crashed

You're not the only one. Pay it back when you can. If you can.

The Federal Reserve System was established in 1913 and became the nation's central bank. One thing it did was control interest rates.

When interest rates increase, banks borrowed less money because they would have more to pay back. When interest rates decrease, banks can borrow more because it is easier to pay back.

In the late 1920s, stocks were costing more than they were worth. Financial experts noticed this and called for the Federal Reserve to raise interest rates so banks would borrow less money and the public would have less money to spend on stocks.

The Federal Reserve ended up just telling banks to stop lending people money to spend on stocks.

There was no punishment if banks didn't stop lending people money, so they continued to do it. No punishment from the government so banks won´t stop.

When the stock market crashed, people could not pay back the loans they had and many suffered with a lot of debt. This was a big cause in the Great Depression. People were on the streets and banks couldn´t do anything about it.

Federal Reserve

Interest rates go down

Interest rates go up

Time to borrow money while it's cheap.

That's gonna be too much money to pay back.

This could be a major problem. The Federal Reserve has to do something about this.

We have told banks to stop lending people so much money for the stock market. Everything will be okay.

Will it...?

Here's your money. Pay it back by the end of the month.

How much longer can we do this for?

Thank you kind sir. I'll get that back as soon as possible.

I knew something like this was going to happen. The Federal Reserve should've done more. They should have known to do more.

Hey, I can't pay back that loan I had after I spent it on stocks. It crashed

You're not the only one. Pay it back when you can. If you can.

Storyboard Text

- Federal Reserve

- Time to borrow money while it's cheap.

- Interest rates go down

- That's gonna be too much money to pay back.

- Interest rates go up

- This could be a major problem. The Federal Reserve has to do something about this.

- The Federal Reserve System was established in 1913 and became the nation's central bank. One thing it did was control interest rates.

- We have told banks to stop lending people so much money for the stock market. Everything will be okay.

- Will it...?

- When interest rates increase, banks borrowed less money because they would have more to pay back. When interest rates decrease, banks can borrow more because it is easier to pay back.

- Thank you kind sir. I'll get that back as soon as possible.

- Here's your money. Pay it back by the end of the month.

- How much longer can we do this for?

- In the late 1920s, stocks were costing more than they were worth. Financial experts noticed this and called for the Federal Reserve to raise interest rates so banks would borrow less money and the public would have less money to spend on stocks.

- I knew something like this was going to happen. The Federal Reserve should've done more. They should have known to do more.

- Hey, I can't pay back that loan I had after I spent it on stocks. It crashed

- You're not the only one. Pay it back when you can. If you can.

- The Federal Reserve ended up just telling banks to stop lending people money to spend on stocks.

- There was no punishment if banks didn't stop lending people money, so they continued to do it. No punishment from the government so banks won´t stop.

- When the stock market crashed, people could not pay back the loans they had and many suffered with a lot of debt. This was a big cause in the Great Depression. People were on the streets and banks couldn´t do anything about it.