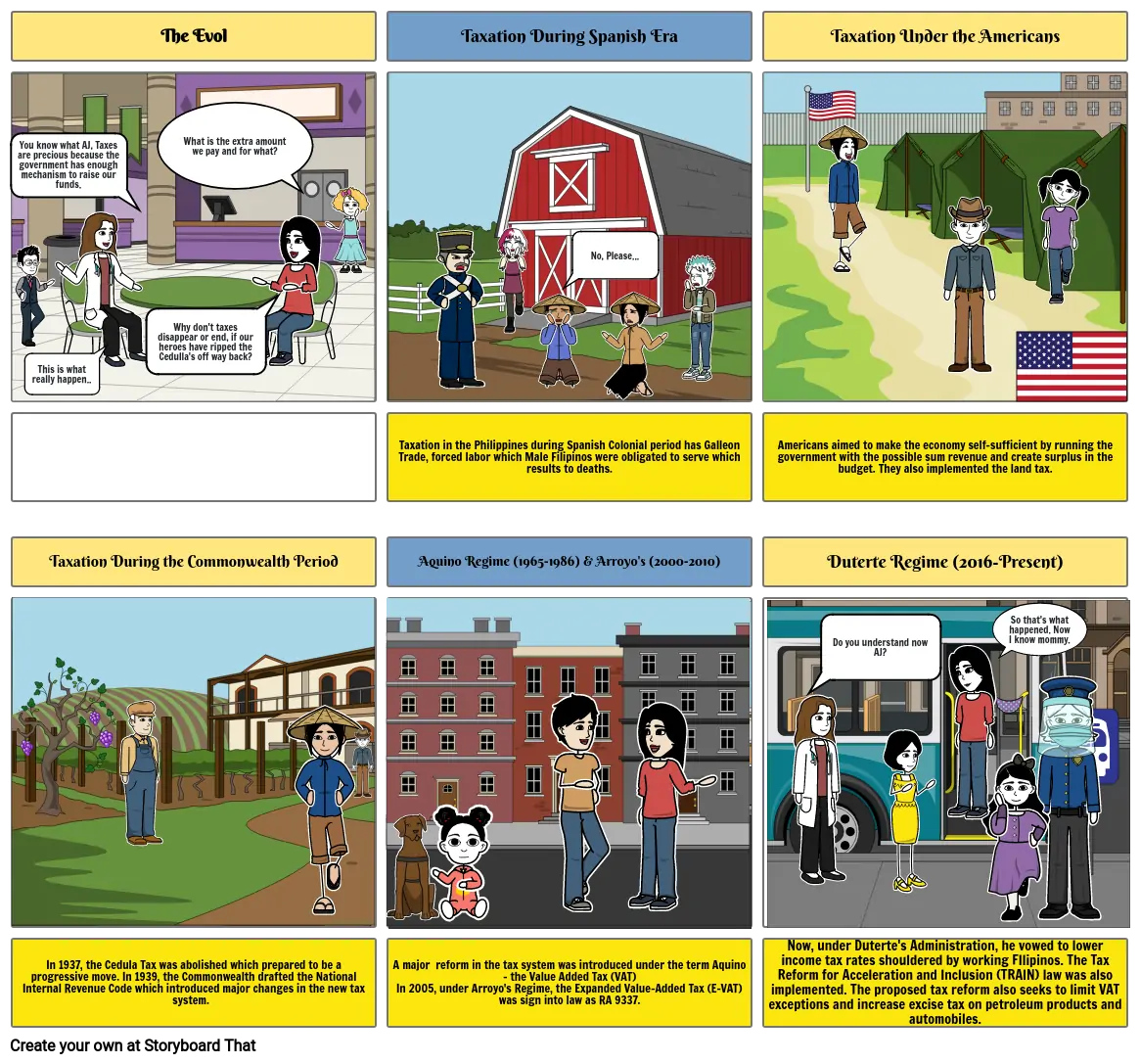

Evolution of Philippine Taxation

Tekst Storyboardowy

- You know what AJ, Taxes are precious because the government has enough mechanism to raise our funds.

- The Evol

- Why don't taxes disappear or end, if our heroes have ripped the Cedulla's off way back?

- What is the extra amount we pay and for what?

- Taxation During Spanish Era

- No, Please...

- Taxation Under the Americans

- Taxation During the Commonwealth Period

- This is what really happen..

- Taxation in the Philippines during Spanish Colonial period has Galleon Trade, forced labor which Male Filipinos were obligated to serve which results to deaths.

- Aquino Regime (1965-1986) & Arroyo's (2000-2010)

- Americans aimed to make the economy self-sufficient by running the government with the possible sum revenue and create surplus in the budget. They also implemented the land tax.

- Duterte Regime (2016-Present)

- Do you understand now AJ?

- So that's what happened. Now I know mommy.

- In 1937, the Cedula Tax was abolished which prepared to be a progressive move. In 1939, the Commonwealth drafted the National Internal Revenue Code which introduced major changes in the new tax system.

- A major reform in the tax system was introduced under the term Aquino - the Value Added Tax (VAT)In 2005, under Arroyo's Regime, the Expanded Value-Added Tax (E-VAT) was sign into law as RA 9337.

- Now, under Duterte's Administration, he vowed to lower income tax rates shouldered by working FIlipinos. The Tax Reform for Acceleration and Inclusion (TRAIN) law was also implemented. The proposed tax reform also seeks to limit VAT exceptions and increase excise tax on petroleum products and automobiles.

Utworzono ponad 30 milionów scenorysów