Consumer Banking ICA2

Storyboard Tekst

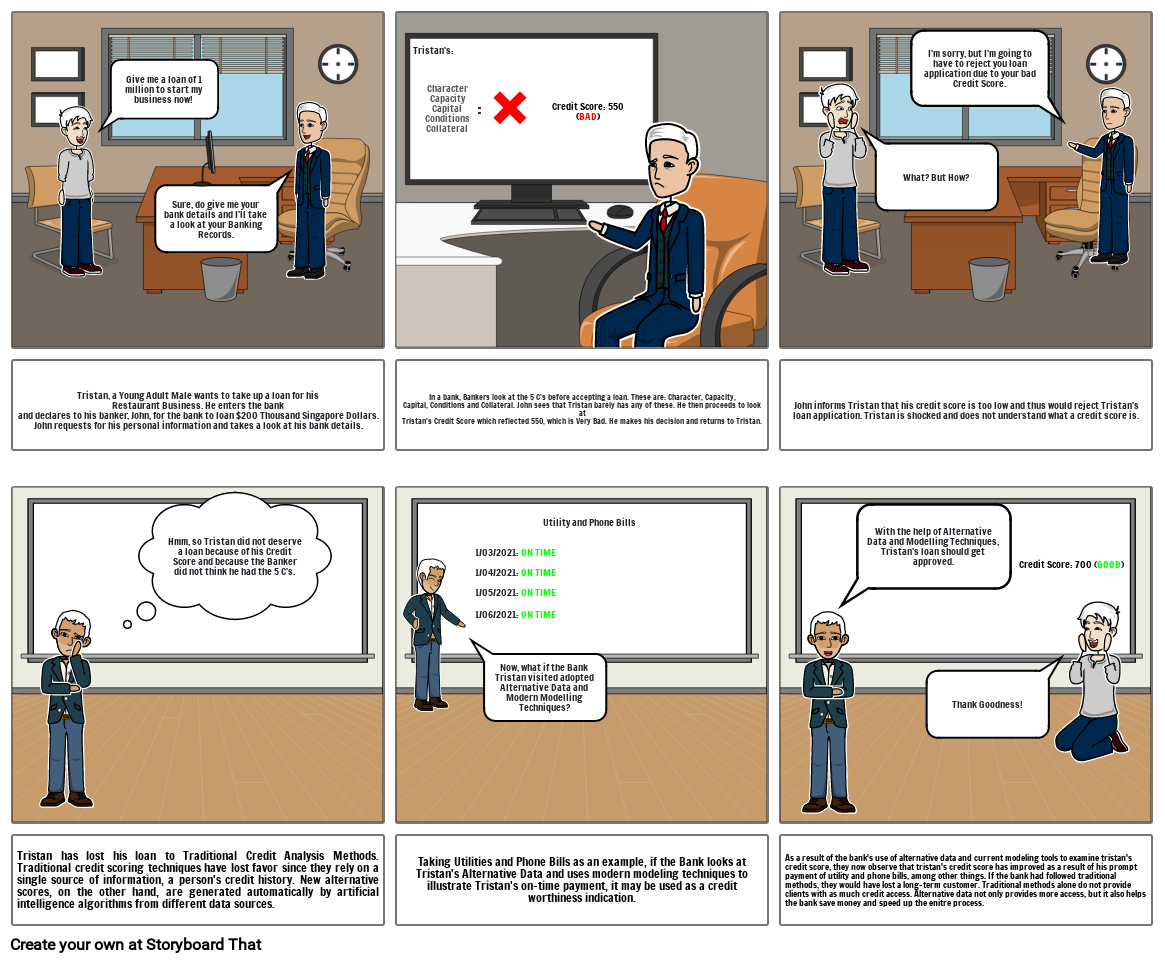

- Give me a loan of 1 million to start my business now!

- Sure, do give me your bank details and I'll take a look at your Banking Records.

- Tristan's:

- CharacterCapacityCapitalConditionsCollateral

- :

- Credit Score: 550 (BAD)

- What? But How?

- I'm sorry, but I'm going to have to reject you loan application due to your bad Credit Score.

- Tristan, a Young Adult Male wants to take up a loan for his Restaurant Business. He enters the bankand declares to his banker, John, for the bank to loan $200 Thousand Singapore Dollars. John requests for his personal information and takes a look at his bank details.

- Hmm, so Tristan did not deserve a loan because of his Credit Score and because the Banker did not think he had the 5 C's.

- In a bank, Bankers look at the 5 C's before accepting a loan. These are: Character, Capacity,Capital, Conditions and Collateral. John sees that Tristan barely has any of these. He then proceeds to look atTristan's Credit Score which reflected 550, which is Very Bad. He makes his decision and returns to Tristan.

- Utility and Phone Bills 1/03/2021: ON TIME1/04/2021: ON TIME1/05/2021: ON TIME1/06/2021: ON TIME

- Now, what if the Bank Tristan visited adopted Alternative Data and Modern Modelling Techniques?

- John informs Tristan that his credit score is too low and thus would reject Tristan'sloan application. Tristan is shocked and does not understand what a credit score is.

- With the help of Alternative Data and Modelling Techniques, Tristan's loan should get approved.

- Thank Goodness!

- Credit Score: 700 (GOOD)

- Tristan has lost his loan to Traditional Credit Analysis Methods. Traditional credit scoring techniques have lost favor since they rely on a single source of information, a person's credit history. New alternative scores, on the other hand, are generated automatically by artificial intelligence algorithms from different data sources.

- Taking Utilities and Phone Bills as an example, if the Bank looks at Tristan's Alternative Data and uses modern modeling techniques to illustrate Tristan's on-time payment, it may be used as a credit worthiness indication.

- As a result of the bank's use of alternative data and current modeling tools to examine tristan's credit score, they now observe that tristan's credit score has improved as a result of his prompt payment of utility and phone bills, among other things. If the bank had followed traditional methods, they would have lost a long-term customer. Traditional methods alone do not provide clients with as much credit access. Alternative data not only provides more access, but it also helps the bank save money and speed up the enitre process.

Over 30 millioner storyboards opprettet