econ project

Storyboard Tekst

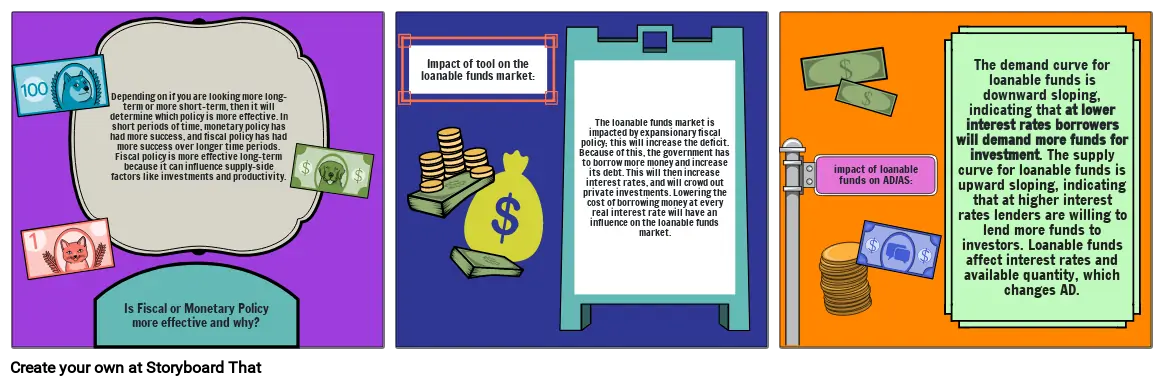

- Depending on if you are looking more long-term or more short-term, then it will determine which policy is more effective. In short periods of time, monetary policy has had more success, and fiscal policy has had more success over longer time periods. Fiscal policy is more effective long-term because it can influence supply-side factors like investments and productivity.

- Is Fiscal or Monetary Policy more effective and why?

- Impact of tool on the loanable funds market:

- The loanable funds market is impacted by expansionary fiscal policy; this will increase the deficit. Because of this, the government has to borrow more money and increase its debt. This will then increase interest rates, and will crowd out private investments. Lowering the cost of borrowing money at every real interest rate will have an influence on the loanable funds market.

- impact of loanable funds on AD/AS:

- The demand curve for loanable funds is downward sloping, indicating that at lower interest rates borrowers will demand more funds for investment. The supply curve for loanable funds is upward sloping, indicating that at higher interest rates lenders are willing to lend more funds to investors. Loanable funds affect interest rates and available quantity, which changes AD.

Meer dan 30 miljoen storyboards gemaakt