Insurance 3

Storyboard Tekst

- Dia: 1

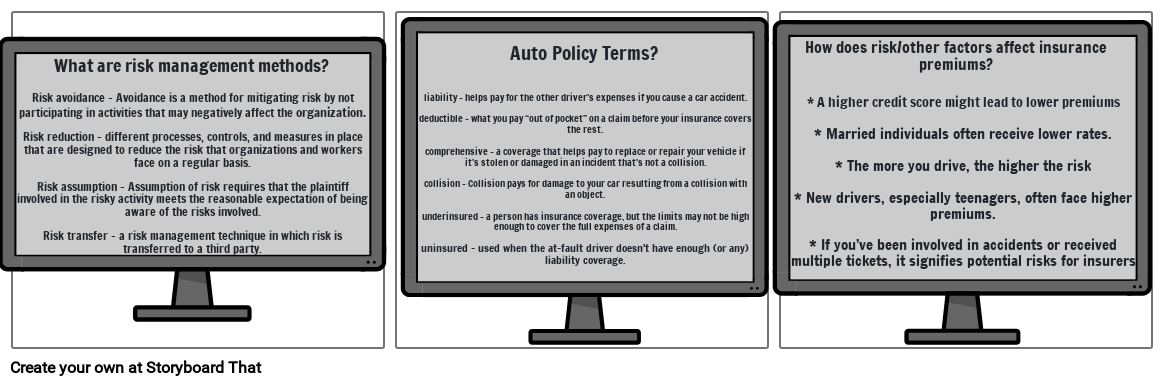

- Risk avoidance - Avoidance is a method for mitigating risk by not participating in activities that may negatively affect the organization.Risk reduction - different processes, controls, and measures in place that are designed to reduce the risk that organizations and workers face on a regular basis.Risk assumption - Assumption of risk requires that the plaintiff involved in the risky activity meets the reasonable expectation of being aware of the risks involved.Risk transfer - a risk management technique in which risk is transferred to a third party.

- What are risk management methods?

- Dia: 2

- liability - helps pay for the other driver's expenses if you cause a car accident.deductible - what you pay “out of pocket” on a claim before your insurance covers the rest.comprehensive - a coverage that helps pay to replace or repair your vehicle if it's stolen or damaged in an incident that's not a collision.collision - Collision pays for damage to your car resulting from a collision with an object.underinsured - a person has insurance coverage, but the limits may not be high enough to cover the full expenses of a claim.uninsured - used when the at-fault driver doesn't have enough (or any) liability coverage.

- Auto Policy Terms?

- Dia: 3

- * A higher credit score might lead to lower premiums* Married individuals often receive lower rates.* The more you drive, the higher the risk* New drivers, especially teenagers, often face higher premiums. * If you’ve been involved in accidents or received multiple tickets, it signifies potential risks for insurers

- How does risk/other factors affect insurance premiums?

Meer dan 30 miljoen storyboards gemaakt