16th amendment.

Storyboard Tekst

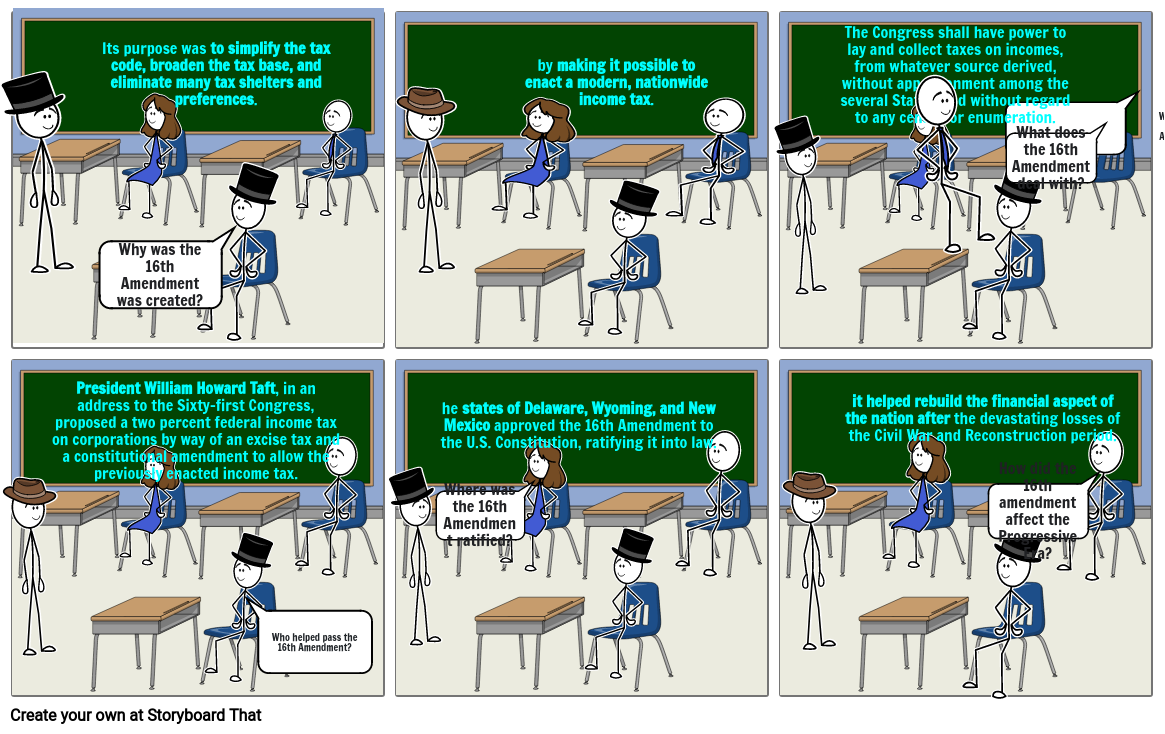

- Its purpose was to simplify the tax code, broaden the tax base, and eliminate many tax shelters and preferences.

- Why was the 16th Amendment was created?

- by making it possible to enact a modern, nationwide income tax.

- The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.

- What does the 16th Amendment deal with?

- What problems did the 16th Amendment solve?

- President William Howard Taft, in an address to the Sixty-first Congress, proposed a two percent federal income tax on corporations by way of an excise tax and a constitutional amendment to allow the previously enacted income tax.

- Who helped pass the 16th Amendment?

- he states of Delaware, Wyoming, and New Mexico approved the 16th Amendment to the U.S. Constitution, ratifying it into law.

- Where was the 16th Amendment ratified?

- it helped rebuild the financial aspect of the nation after the devastating losses of the Civil War and Reconstruction period.

- How did the 16th amendment affect the Progressive Era?

Meer dan 30 miljoen storyboards gemaakt