ICA2 STORYBOARD

Montāžas Teksta

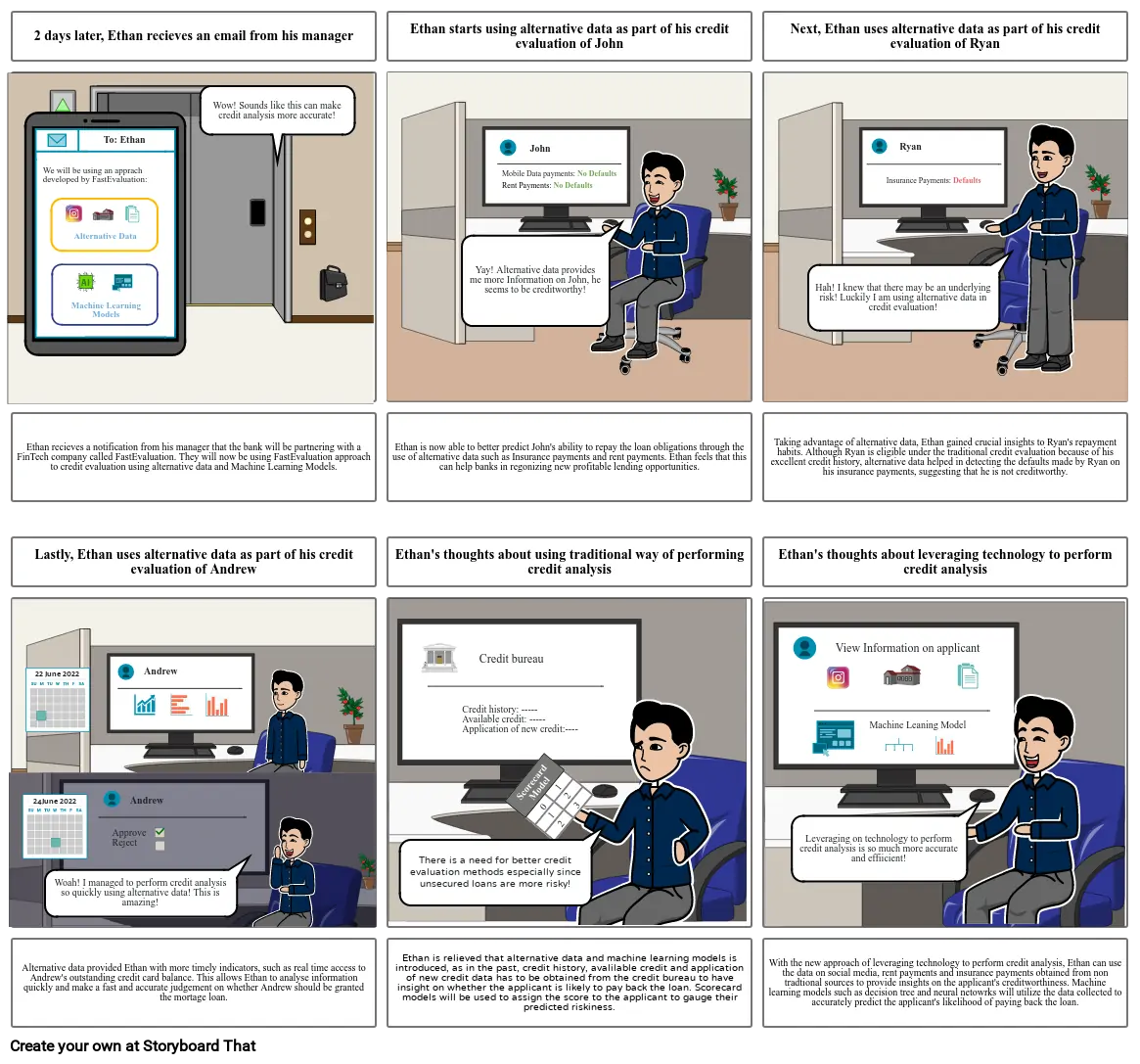

- 2 days later, Ethan recieves an email from his manager

- To: Ethan

- We will be using an apprach developed by FastEvaluation:

- Alternative Data

- Machine Learning Models

- AI

- Wow! Sounds like this can make credit analysis more accurate!

- Ethan starts using alternative data as part of his credit evaluation of John

- Yay! Alternative data provides me more Information on John, he seems to be creditworthy!

- Rent Payments: No Defaults

- Mobile Data payments: No Defaults

- John

- Next, Ethan uses alternative data as part of his credit evaluation of Ryan

- Hah! I knew that there may be an underlying risk! Luckily I am using alternative data in credit evaluation!

- Insurance Payments: Defaults

- Ryan

- Ethan recieves a notification from his manager that the bank will be partnering with a FinTech company called FastEvaluation. They will now be using FastEvaluation approach to credit evaluation using alternative data and Machine Learning Models.

- Lastly, Ethan uses alternative data as part of his credit evaluation of Andrew

- 22 June 2022

- Andrew

- Ethan is now able to better predict John's ability to repay the loan obligations through the use of alternative data such as Insurance payments and rent payments. Ethan feels that this can help banks in regonizing new profitable lending opportunities.

- Ethan's thoughts about using traditional way of performing credit analysis

- Credit history: -----Available credit: -----Application of new credit:----

- Credit bureau

- Taking advantage of alternative data, Ethan gained crucial insights to Ryan's repayment habits. Although Ryan is eligible under the traditional credit evaluation because of his excellent credit history, alternative data helped in detecting the defaults made by Ryan on his insurance payments, suggesting that he is not creditworthy.

- Ethan's thoughts about leveraging technology to perform credit analysis

- View Information on applicant

- Machine Leaning Model

- Alternative data provided Ethan with more timely indicators, such as real time access to Andrew's outstanding credit card balance. This allows Ethan to analyse information quickly and make a fast and accurate judgement on whether Andrew should be granted the mortage loan.

- 24June 2022

- Woah! I managed to perform credit analysis so quickly using alternative data! This is amazing!

- Andrew

- ApproveReject

- Ethan is relieved that alternative data and machine learning models is introduced, as in the past, credit history, avalilable credit and application of new credit data has to be obtained from the credit bureau to have insight on whether the applicant is likely to pay back the loan. Scorecard models will be used to assign the score to the applicant to gauge their predicted riskiness.

- There is a need for better credit evaluation methods especially since unsecured loans are more risky!

- 0

- Scorecard Model

- 1

- 1

- 2

- 2

- 3

- With the new approach of leveraging technology to perform credit analysis, Ethan can use the data on social media, rent payments and insurance payments obtained from non tradtional sources to provide insights on the applicant's creditworthiness. Machine learning models such as decision tree and neural netowrks will utilize the data collected to accurately predict the applicant's likelihood of paying back the loan.

- Leveraging on technology to perform credit analysis is so much more accurate and effiicient!

Izveidoti vairāk nekā 30 miljoni stāstu shēmu