Consumer banking ica

Montāžas Teksta

- Slidkalniņš: 1

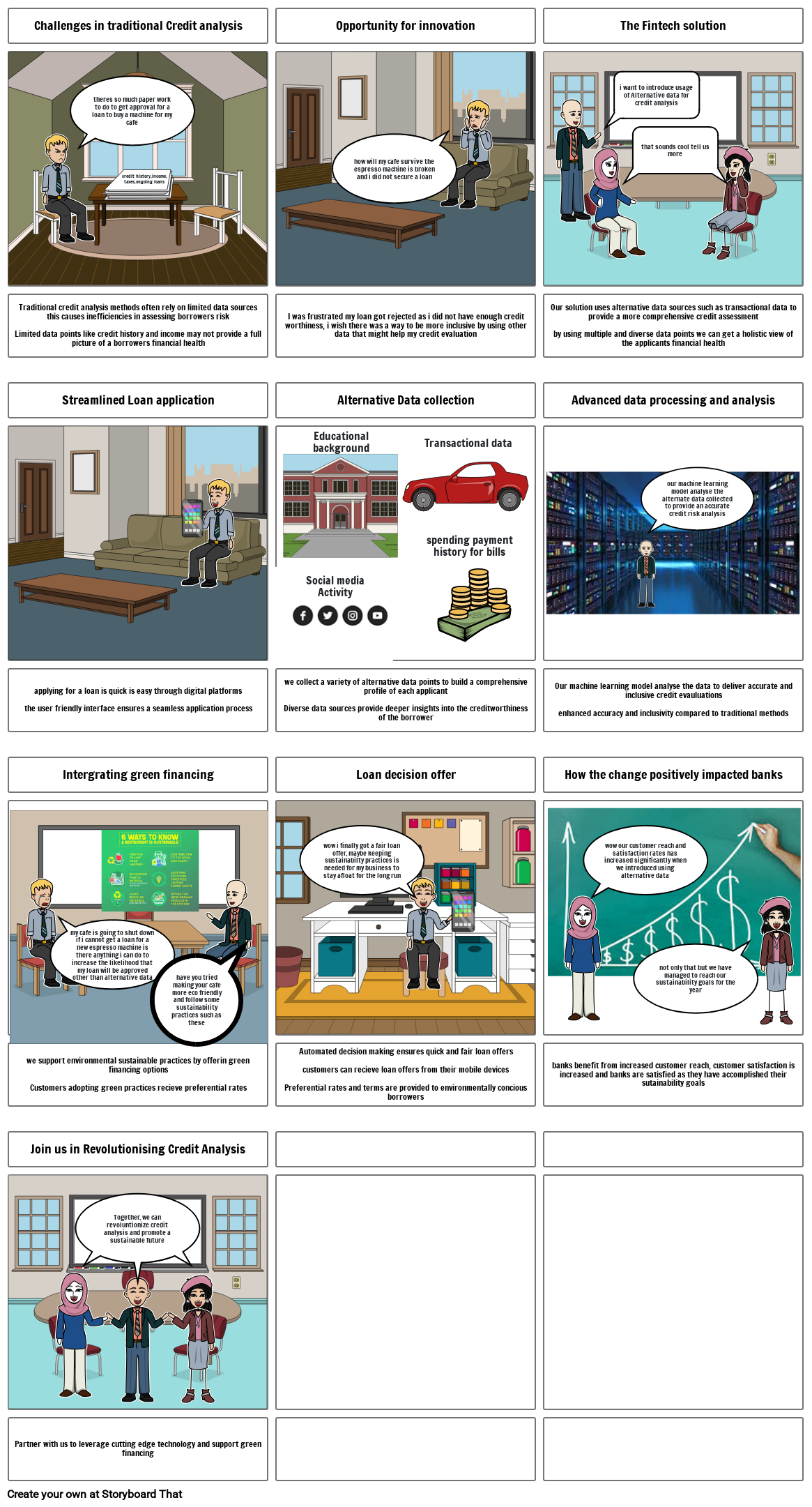

- Challenges in traditional Credit analysis

- theres so much paper work to do to get approval for a loan to buy a machine for my cafe

- credit history,income,taxes, ongoing loans

- Traditional credit analysis methods often rely on limited data sources this causes inefficiencies in assessing borrowers risk Limited data points like credit history and income may not provide a full picture of a borrowers financial health

- Slidkalniņš: 2

- Opportunity for innovation

- how will my cafe survive the espresso machine is broken and i did not secure a loan

- I was frustrated my loan got rejected as i did not have enough credit worthiness, i wish there was a way to be more inclusive by using other data that might help my credit evaluation

- Slidkalniņš: 3

- The Fintech solution

- Our solution uses alternative data sources such as transactional data to provide a more comprehensive credit assessment by using multiple and diverse data points we can get a holistic view of the applicants financial health

- Slidkalniņš: 4

- Streamlined Loan application

- applying for a loan is quick is easy through digital platforms the user friendly interface ensures a seamless application process

- Slidkalniņš: 5

- Alternative Data collection

- we collect a variety of alternative data points to build a comprehensive profile of each applicant Diverse data sources provide deeper insights into the creditworthiness of the borrower

- Slidkalniņš: 6

- Advanced data processing and analysis

- Our machine learning model analyse the data to deliver accurate and inclusive credit evauluations enhanced accuracy and inclusivity compared to traditional methods

- Slidkalniņš: 7

- Intergrating green financing

Izveidoti vairāk nekā 30 miljoni stāstu shēmu