The Evolution Of Philippine Taxation

Montāžas Teksta

- Slidkalniņš: 1

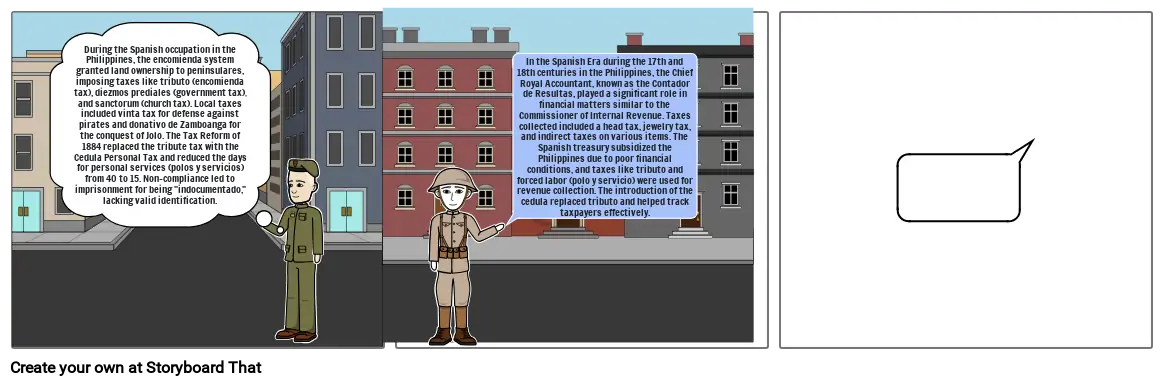

- During the Spanish occupation in the Philippines, the encomienda system granted land ownership to peninsulares, imposing taxes like tributo (encomienda tax), diezmos prediales (government tax), and sanctorum (church tax). Local taxes included vinta tax for defense against pirates and donativo de Zamboanga for the conquest of Jolo. The Tax Reform of 1884 replaced the tribute tax with the Cedula Personal Tax and reduced the days for personal services (polos y servicios) from 40 to 15. Non-compliance led to imprisonment for being "indocumentado," lacking valid identification.

- Slidkalniņš: 2

- In the Spanish Era during the 17th and 18th centuries in the Philippines, the Chief Royal Accountant, known as the Contador de Resultas, played a significant role in financial matters similar to the Commissioner of Internal Revenue. Taxes collected included a head tax, jewelry tax, and indirect taxes on various items. The Spanish treasury subsidized the Philippines due to poor financial conditions, and taxes like tributo and forced labor (polo y servicio) were used for revenue collection. The introduction of the cedula replaced tributo and helped track taxpayers effectively.

Izveidoti vairāk nekā 30 miljoni stāstu shēmu