FINAL OUTPUT

Montāžas Teksta

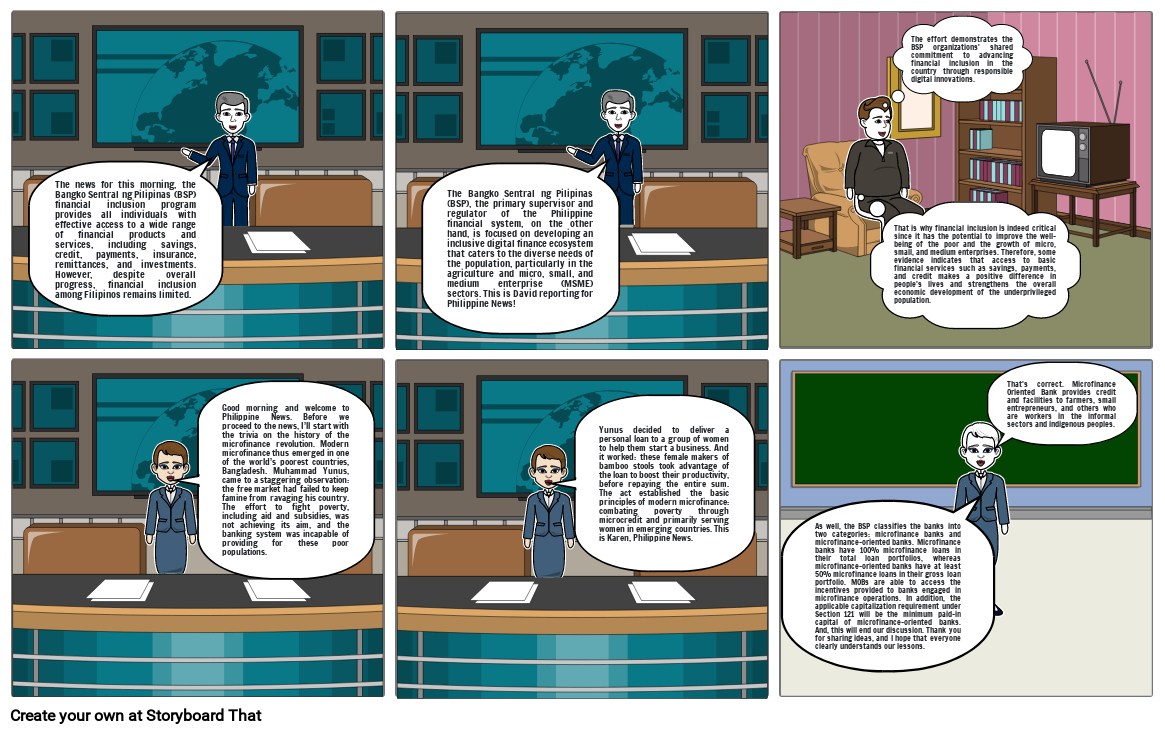

- The news for this morning, the Bangko Sentral ng Pilipinas (BSP) financial inclusion program provides all individuals with effective access to a wide range of financial products and services, including savings, credit, payments, insurance, remittances, and investments. However, despite overall progress, financial inclusion among Filipinos remains limited.

- Good morning, class! Can anyone share a research about the National Strategy for Microfinance?

- The Bangko Sentral ng Pilipinas (BSP), the primary supervisor and regulator of the Philippine financial system, on the other hand, is focused on developing an inclusive digital finance ecosystem that caters to the diverse needs of the population, particularly in the agriculture and micro, small, and medium enterprise (MSME) sectors. This is David reporting for Philippine News!

- That is why financial inclusion is indeed critical since it has the potential to improve the well-being of the poor and the growth of micro, small, and medium enterprises. Therefore, some evidence indicates that access to basic financial services such as savings, payments, and credit makes a positive difference in people's lives and strengthens the overall economic development of the underprivileged population.

- The effort demonstrates the BSP organizations' shared commitment to advancing financial inclusion in the country through responsible digital innovations.

- Good morning and welcome to Philippine News. Before we proceed to the news, I’ll start with the trivia on the history of the microfinance revolution. Modern microfinance thus emerged in one of the world’s poorest countries, Bangladesh. Muhammad Yunus, came to a staggering observation: the free market had failed to keep famine from ravaging his country. The effort to fight poverty, including aid and subsidies, was not achieving its aim, and the banking system was incapable of providing for these poor populations.

- Yunus decided to deliver a personal loan to a group of women to help them start a business. And it worked: these female makers of bamboo stools took advantage of the loan to boost their productivity, before repaying the entire sum. The act established the basic principles of modern microfinance: combating poverty through microcredit and primarily serving women in emerging countries. This is Karen, Philippine News.

- As well, the BSP classifies the banks into two categories: microfinance banks and microfinance-oriented banks. Microfinance banks have 100% microfinance loans in their total loan portfolios, whereas microfinance-oriented banks have at least 50% microfinance loans in their gross loan portfolio. MOBs are able to access the incentives provided to banks engaged in microfinance operations. In addition, the applicable capitalization requirement under Section 121 will be the minimum paid-in capital of microfinance-oriented banks. And, this will end our discussion. Thank you for sharing ideas, and I hope that everyone clearly understands our lessons.

- That's correct. Microfinance Oriented Bank provides credit and facilities to farmers, small entrepreneurs, and others who are workers in the informal sectors and indigenous peoples.

Izveidoti vairāk nekā 30 miljoni stāstu shēmu