Unknown Story

Siužetinės Linijos Tekstas

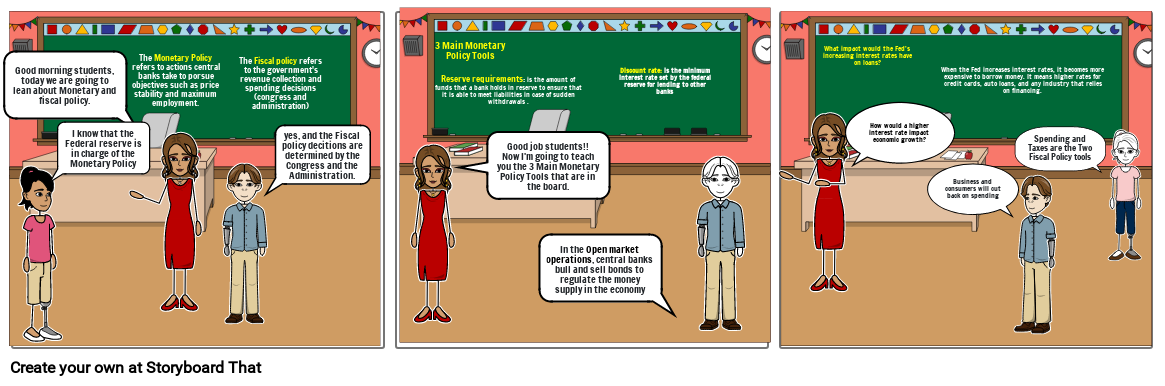

- Good morning students, today we are going to lean about Monetary and fiscal policy.

- I know that the Federal reserve is in charge of the Monetary Policy

- The Monetary Policy refers to actions central banks take to porsue objectives such as price stability and maximum employment.

- The Fiscal policy refers to the government's revenue collection and spending decisions (congress and administration)

- yes, and the Fiscal policy decitions are determined by the Congress and the Administration.

- 3 Main Monetary Policy Tools

- Reserve requirements: is the amount of funds that a bank holds in reserve to ensure that it is able to meet liabilities in case of sudden withdrawals .

- Good job students!!Now I'm going to teach you the 3 Main Monetary Policy Tools that are in the board.

- In the Open market operations, central banks bull and sell bonds to regulate the money supply in the economy

- Discount rate: is the minimum interest rate set by the federal reserve for lending to other banks

- What impact would the Fed’s increasing interest rates have on loans?

- How would a higher interest rate impact economic growth?

- Business and consumers will cut back on spending

- When the Fed increases interest rates, it becomes more expensive to borrow money. It means higher rates for credit cards, auto loans, and any industry that relies on financing.

- Spending and Taxes are the Two Fiscal Policy tools

Sukurta daugiau nei 30 milijonų siužetinių lentelių