Money A+E (Part 1)

Siužetinės Linijos Aprašymas

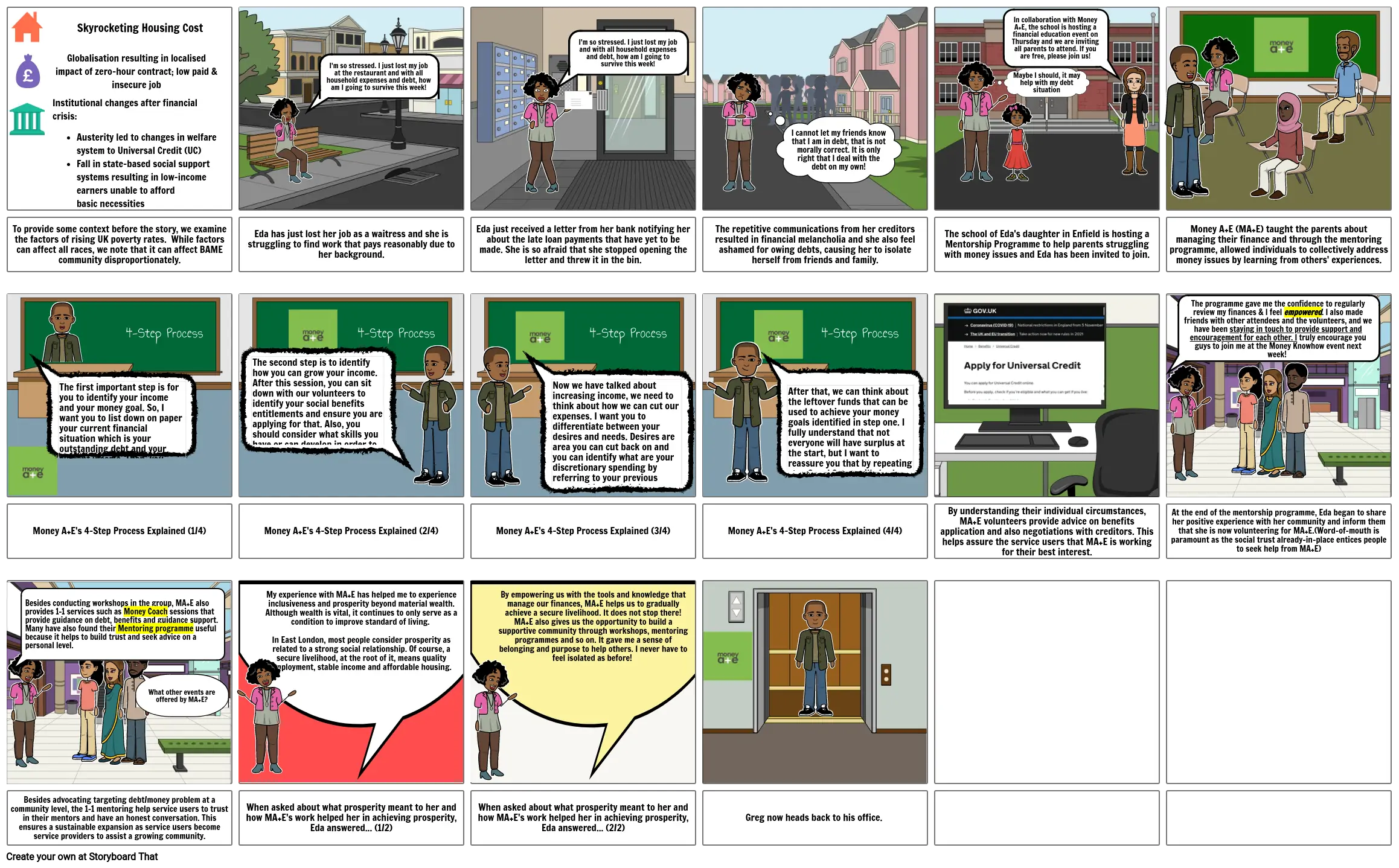

Part 1 provides a background on the money or debt situation commonly faced by the individuals that Money A+E work with. Here, we address how Money A+E's work is innovative in that it works on team-based solution and focus on building individual confidence in managing the finances. We use a fictional character named Omolade to illustrate the front-line work of Money A+E.

Siužetinės Linijos Tekstas

- Institutional changes after financial crisis:Austerity led to changes in welfare system to Universal Credit (UC)Fall in state-based social support systems resulting in low-income earners unable to afford basic necessities

- Globalisation resulting in localised impact of zero-hour contract; low paid & insecure job

- Skyrocketing Housing Cost

- I'm so stressed. I just lost my job at the restaurant and with all household expenses and debt, how am I going to survive this week!

- I'm so stressed. I just lost my job and with all household expenses and debt, how am I going to survive this week!

- I cannot let my friends know that I am in debt, that is not morally correct. It is only right that I deal with the debt on my own!

- Maybe I should, it may help with my debt situation

- In collaboration with Money A+E, the school is hosting a financial education event on Thursday and we are inviting all parents to attend. If you are free, please join us!

- To provide some context before the story, we examine the factors of rising UK poverty rates. While factors can affect all races, we note that it can affect BAME community disproportionately.

- The first important step is for you to identify your income and your money goal. So, I want you to list down on paper your current financial situation which is your outstanding debt and your current income. Then, you should foresee a money goal to achieve.

- 4-Step Process

- The second step is to identify how you can grow your income. After this session, you can sit down with our volunteers to identify your social benefits entitlements and ensure you are applying for that. Also, you should consider what skills you have or can develop in order to increase your employability to get better paying job.

- Eda has just lost her job as a waitress and she is struggling to find work that pays reasonably due to her background.

- 4-Step Process

- Eda just received a letter from her bank notifying her about the late loan payments that have yet to be made. She is so afraid that she stopped opening the letter and threw it in the bin.

- Now we have talked about increasing income, we need to think about how we can cut our expenses. I want you to differentiate between your desires and needs. Desires are area you can cut back on and you can identify what are your discretionary spending by referring to your previous expense history. It is important you also spend 10 minutes every day to look at areas of spending.

- 4-Step Process

- The repetitive communications from her creditors resulted in financial melancholia and she also feel ashamed for owing debts, causing her to isolate herself from friends and family.

- After that, we can think about the leftover funds that can be used to achieve your money goals identified in step one. I fully understand that not everyone will have surplus at the start, but I want to reassure you that by repeating step 2 and 3, you will slowly accumulate surplus.

- 4-Step Process

- The school of Eda's daughter in Enfield is hosting a Mentorship Programme to help parents struggling with money issues and Eda has been invited to join.

- The programme gave me the confidence to regularly review my finances & I feel empowered. I also made friends with other attendees and the volunteers, and we have been staying in touch to provide support and encouragement for each other. I truly encourage you guys to join me at the Money Knowhow event next week!

- Money A+E (MA+E) taught the parents about managing their finance and through the mentoring programme, allowed individuals to collectively address money issues by learning from others' experiences.

- Money A+E's 4-Step Process Explained (1/4)

- Besides conducting workshops in the group, MA+E also provides 1-1 services such as Money Coach sessions that provide guidance on debt, benefits and guidance support. Many have also found their Mentoring programme useful because it helps to build trust and seek advice on a personal level.

- My experience with MA+E has helped me to experience inclusiveness and prosperity beyond material wealth. Although wealth is vital, it continues to only serve as a condition to improve standard of living. In East London, most people consider prosperity as related to a strong social relationship. Of course, a secure livelihood, at the root of it, means quality employment, stable income and affordable housing.

- Money A+E's 4-Step Process Explained (2/4)

- By empowering us with the tools and knowledge that manage our finances, MA+E helps us to gradually achieve a secure livelihood. It does not stop there! MA+E also gives us the opportunity to build a supportive community through workshops, mentoring programmes and so on. It gave me a sense of belonging and purpose to help others. I never have to feel isolated as before!

- Money A+E's 4-Step Process Explained (3/4)

- Money A+E's 4-Step Process Explained (4/4)

- By understanding their individual circumstances, MA+E volunteers provide advice on benefits application and also negotiations with creditors. This helps assure the service users that MA+E is working for their best interest.

- At the end of the mentorship programme, Eda began to share her positive experience with her community and inform them that she is now volunteering for MA+E.(Word-of-mouth is paramount as the social trust already-in-place entices people to seek help from MA+E)

- Besides advocating targeting debt/money problem at a community level, the 1-1 mentoring help service users to trust in their mentors and have an honest conversation. This ensures a sustainable expansion as service users become service providers to assist a growing community.

- What other events are offered by MA+E?

- When asked about what prosperity meant to her and how MA+E's work helped her in achieving prosperity, Eda answered... (1/2)

- When asked about what prosperity meant to her and how MA+E's work helped her in achieving prosperity, Eda answered... (2/2)

- Greg now heads back to his office.

Sukurta daugiau nei 30 milijonų siužetinių lentelių

Nereikia Atsisiuntimų, Nereikia Kredito Kortelės ir Nereikia Prisijungti!