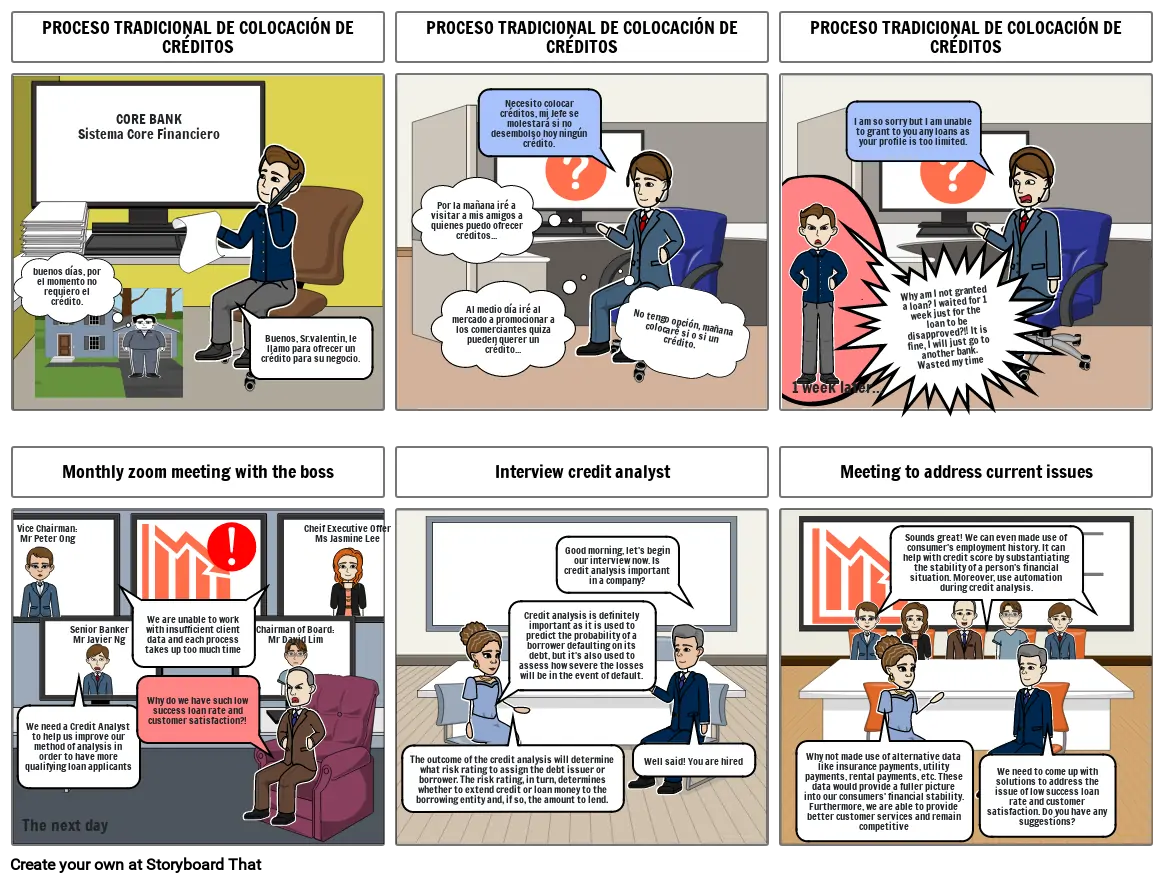

MEJORA DEL PROCESO DE COLOCACIÓN DE CRÉDITOS

Siužetinės Linijos Tekstas

- PROCESO TRADICIONAL DE COLOCACIÓN DE CRÉDITOS

- buenos días, por el momento no requiero el crédito.

- CORE BANKSistema Core Financiero

- Buenos, Sr.valentin, le llamo para ofrecer un crédito para su negocio.

- PROCESO TRADICIONAL DE COLOCACIÓN DE CRÉDITOS

- Al medio día iré al mercado a promocionar a los comerciantes quiza pueden querer un crédito...

- Necesito colocar créditos, mi Jefe se molestará si no desembolso hoy ningún crédito.

- Por la mañana iré a visitar a mis amigos a quienes puedo ofrecer créditos...

- No tengo opción, mañana colocaré si o si un crédito.

- .

- PROCESO TRADICIONAL DE COLOCACIÓN DE CRÉDITOS

- 1 week later...

- Why am I not granted a loan? I waited for 1 week just for the loan to be disapproved?!! It is fine, I will just go to another bank. Wasted my time

- I am so sorry but I am unable to grant to you any loans as your profile is too limited.

- Vice Chairman:Mr Peter Ong

- Monthly zoom meeting with the boss

- Senior BankerMr Javier Ng

- We are unable to work with insufficient client data and each process takes up too much time

- Why do we have such low success loan rate and customer satisfaction?!

- Chairman of Board:Mr David Lim

- Cheif Executive OfferMs Jasmine Lee

- Interview credit analyst

- Credit analysis is definitely important as it is used to predict the probability of a borrower defaulting on its debt, but it's also used to assess how severe the losses will be in the event of default.

- Good morning, let's begin our interview now. Is credit analysis important in a company?

- Meeting to address current issues

- Sounds great! We can even made use of consumer's employment history. It can help with credit score by substantiating the stability of a person’s financial situation. Moreover, use automation during credit analysis.

- Solutions??

- We need a Credit Analyst to help us improve our method of analysis in order to have more qualifying loan applicants

- The next day

- The outcome of the credit analysis will determine what risk rating to assign the debt issuer or borrower. The risk rating, in turn, determines whether to extend credit or loan money to the borrowing entity and, if so, the amount to lend.

- A week later..

- Well said! You are hired

- Why not made use of alternative data like insurance payments, utility payments, rental payments, etc. These data would provide a fuller picture into our consumers' financial stability. Furthermore, we are able to provide better customer services and remain competitive

- We need to come up with solutions to address the issue of low success loan rate and customer satisfaction. Do you have any suggestions?

Sukurta daugiau nei 30 milijonų siužetinių lentelių