Unknown Story

Siužetinės Linijos Tekstas

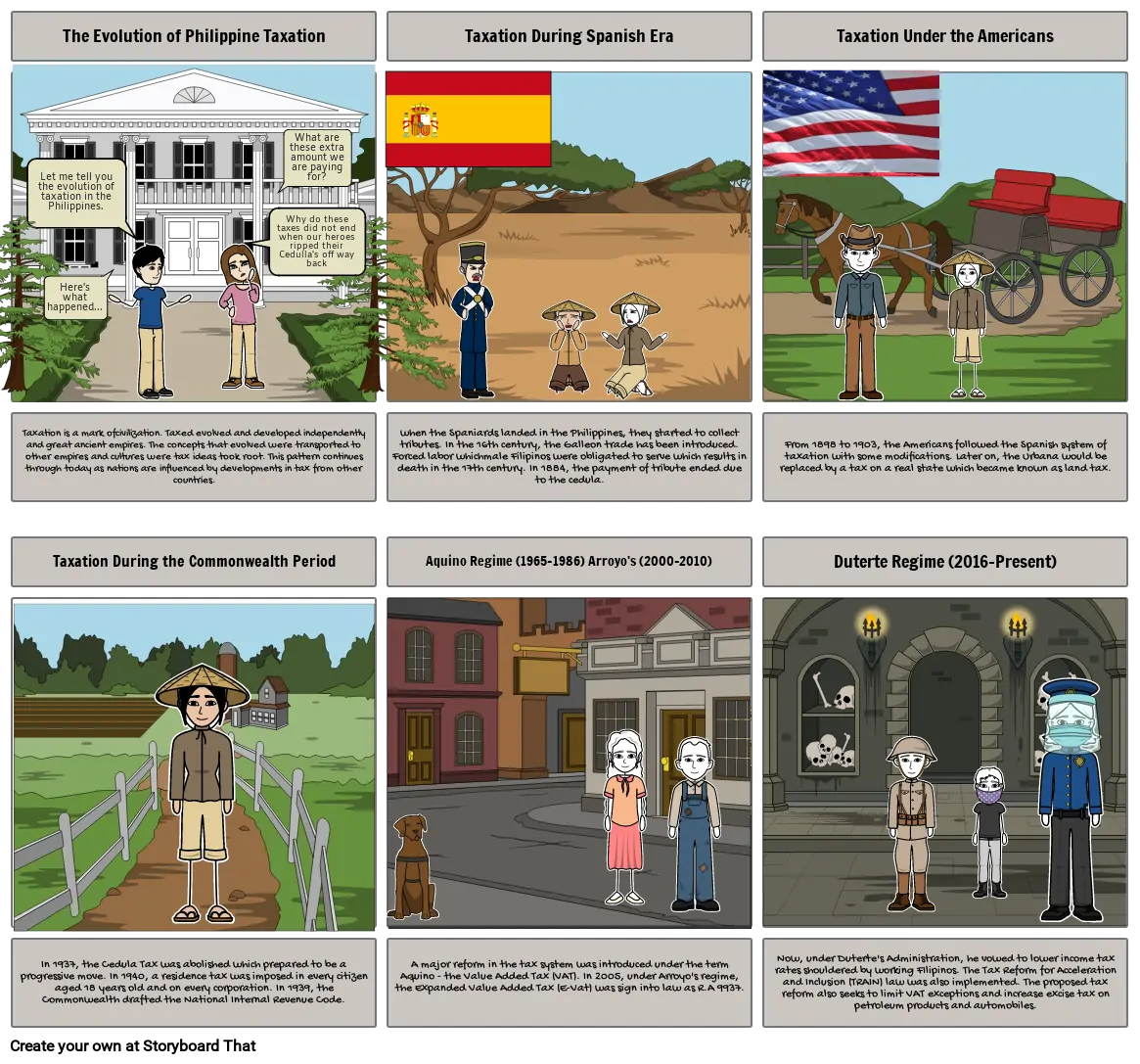

- The Evolution of Philippine Taxation

- Let me tell you the evolution of taxation in the Philippines.

- Here's what happened...

- Why do these taxes did not end when our heroes ripped their Cedulla's off way back

- What are these extra amount we are paying for?

- Taxation During Spanish Era

- Taxation Under the Americans

- Taxation is a mark ofcivilization. Taxed evolved and developed independently and great ancient empires. The concepts that evolved were transported to other empires and cultures were tax ideas took root. This pattern continues through today as nations are influenced by developments in tax from other countries.

- Taxation During the Commonwealth Period

- when the Spaniards landed in the Philippines, they started to collect tributes. In the 16th century, the Galleon trade has been introduced. Forced labor whichmale Filipinos were obligated to serve which results in death in the 17th century. In 1884, the payment of tribute ended due to the cedula.

- Aquino Regime (1965-1986) Arroyo's (2000-2010)

- From 1898 to 1903, the Americans followed the Spanish system of taxation with some modifications. Later on, the Urbana would be replaced by a tax on a real state which became known as land tax.

- Duterte Regime (2016-Present)

- In 1937, the Cedula Tax was abolished which prepared to be a progressive move. In 1940, a residence tax was imposed in every citizen aged 18 years old and on every corporation. In 1939, the Commonwealth drafted the National Internal Revenue Code.

- A major reform in the tax system was introduced under the term Aquino - the Value Added Tax (VAT). In 2005, under Arroyo's regime, the Expanded Value Added Tax (E-Vat) was sign into law as R.A 9937.

- Now, under Duterte's Administration, he vowed to lower income tax rates shouldered by working FIlipinos. The Tax Reform for Acceleration and Inclusion (TRAIN) law was also implemented. The proposed tax reform also seeks to limit VAT exceptions and increase excise tax on petroleum products and automobiles.

Sukurta daugiau nei 30 milijonų siužetinių lentelių