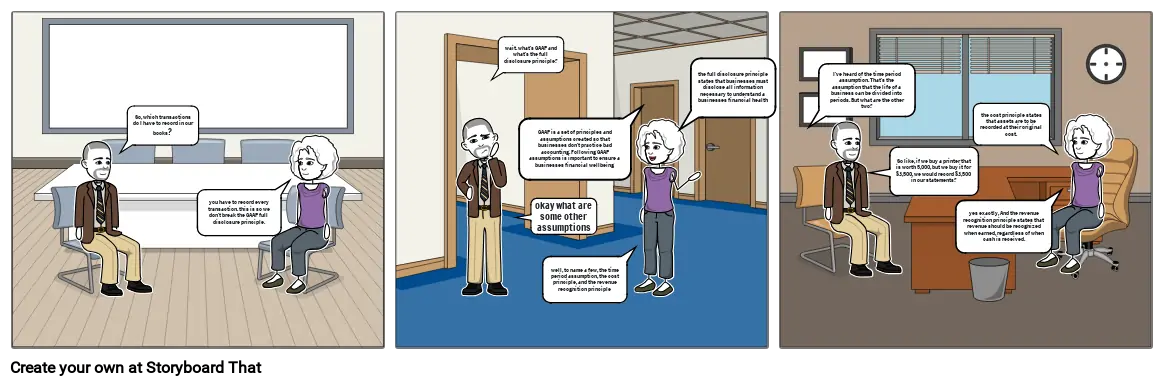

GAAP storyboard

Storyboard Szöveg

- Csúszik: 1

- So, which transactions do I have to record in our books?

- you have to record every transaction. this is so we don't break the GAAP full disclosure principle.

- Csúszik: 2

- wait. what's GAAP and what's the full disclosure principle?

- the full disclosure principle states that businesses must disclose all information necessary to understand a businesses financial health

- GAAP is a set of principles and assumptions created so that businesses don't practice bad accounting. Following GAAP assumptions is important to ensure a businesses financial wellbeing

- okay what are some other assumptions?

- well, to name a few, the time period assumption, the cost principle, and the revenue recognition principle

- Csúszik: 3

- I've heard of the time period assumption. That's the assumption that the life of a business can be divided into periods. But what are the other two?

- the cost principle states that assets are to be recorded at their original cost.

- So like, if we buy a printer that is worth 5,000, but we buy it for $3,500, we would record $3,500 in our statements?

- yes exactly, And the revenue recognition principle states that revenue should be recognized when earned, regardless of when cash is received.

Több mint 30 millió storyboard készült