Unknown Story

Storyboard Tekst

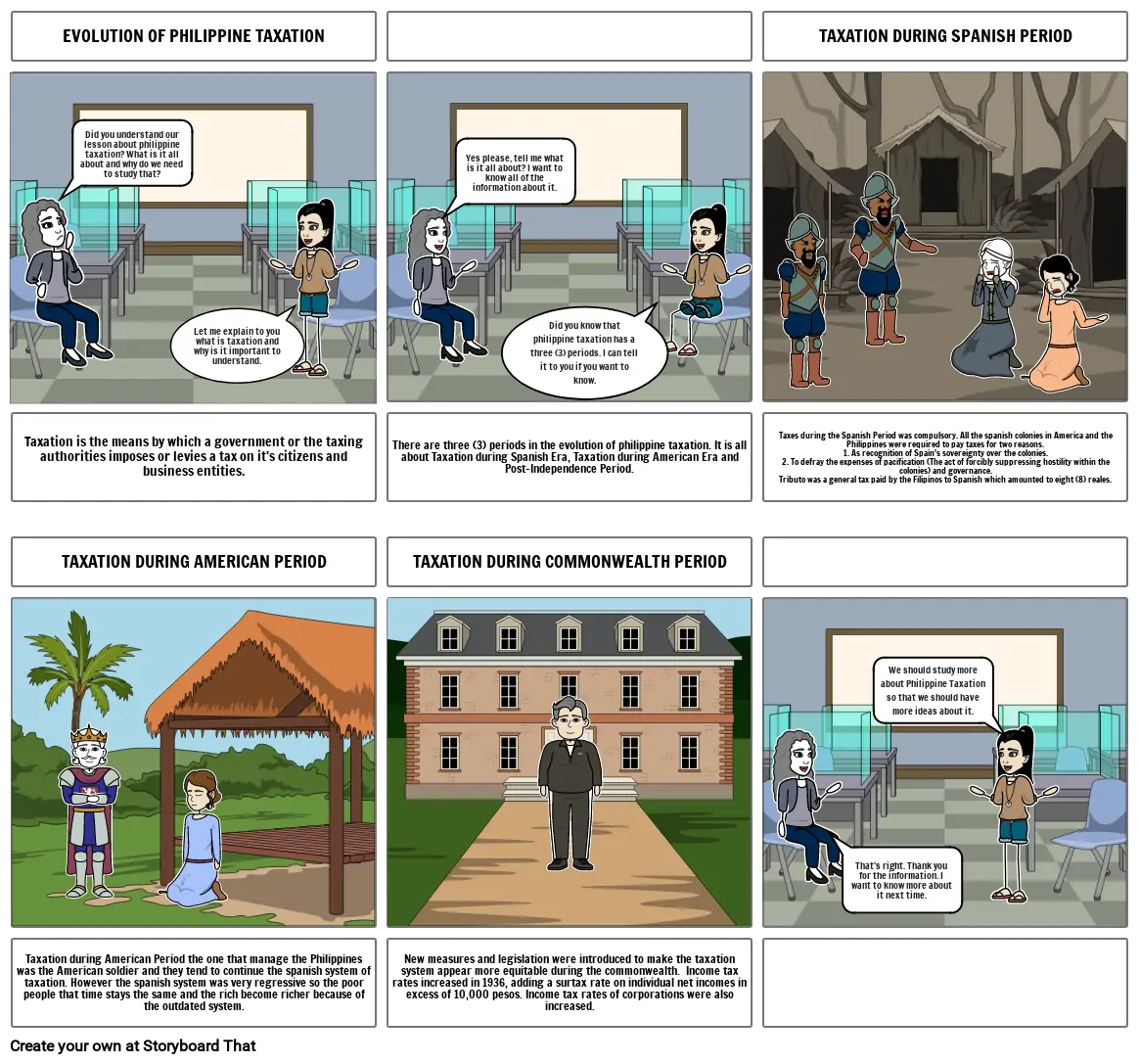

- EVOLUTION OF PHILIPPINE TAXATION

- Did you understand our lesson about philippine taxation? What is it all about and why do we need to study that?

- Let me explain to you what is taxation and why is it important to understand.

- Yes please, tell me what is it all about? I want to know all of the information about it.

- Did you know that philippine taxation has a three (3) periods. I can tell it to you if you want to know.

- TAXATION DURING SPANISH PERIOD

- Taxation is the means by which a government or the taxing authorities imposes or levies a tax on it's citizens and business entities.

- TAXATION DURING AMERICAN PERIOD

- There are three (3) periods in the evolution of philippine taxation. It is all about Taxation during Spanish Era, Taxation during American Era and Post-Independence Period.

- TAXATION DURING COMMONWEALTH PERIOD

- Taxes during the Spanish Period was compulsory. All the spanish colonies in America and the Philippines were required to pay taxes for two reasons.1. As recognition of Spain's sovereignty over the colonies.2. To defray the expenses of pacification (The act of forcibly suppressing hostility within the colonies) and governance.Tributo was a general tax paid by the Filipinos to Spanish which amounted to eight (8) reales.

- We should study more about Philippine Taxation so that we should have more ideas about it.

- Taxation during American Period the one that manage the Philippines was the American soldier and they tend to continue the spanish system of taxation. However the spanish system was very regressive so the poor people that time stays the same and the rich become richer because of the outdated system.

- New measures and legislation were introduced to make the taxation system appear more equitable during the commonwealth. Income tax rates increased in 1936, adding a surtax rate on individual net incomes in excess of 10,000 pesos. Income tax rates of corporations were also increased.

- That's right. Thank you for the information. I want to know more about it next time.

Izrađeno više od 30 milijuna scenarija