Unknown Story

स्टोरीबोर्ड पाठ

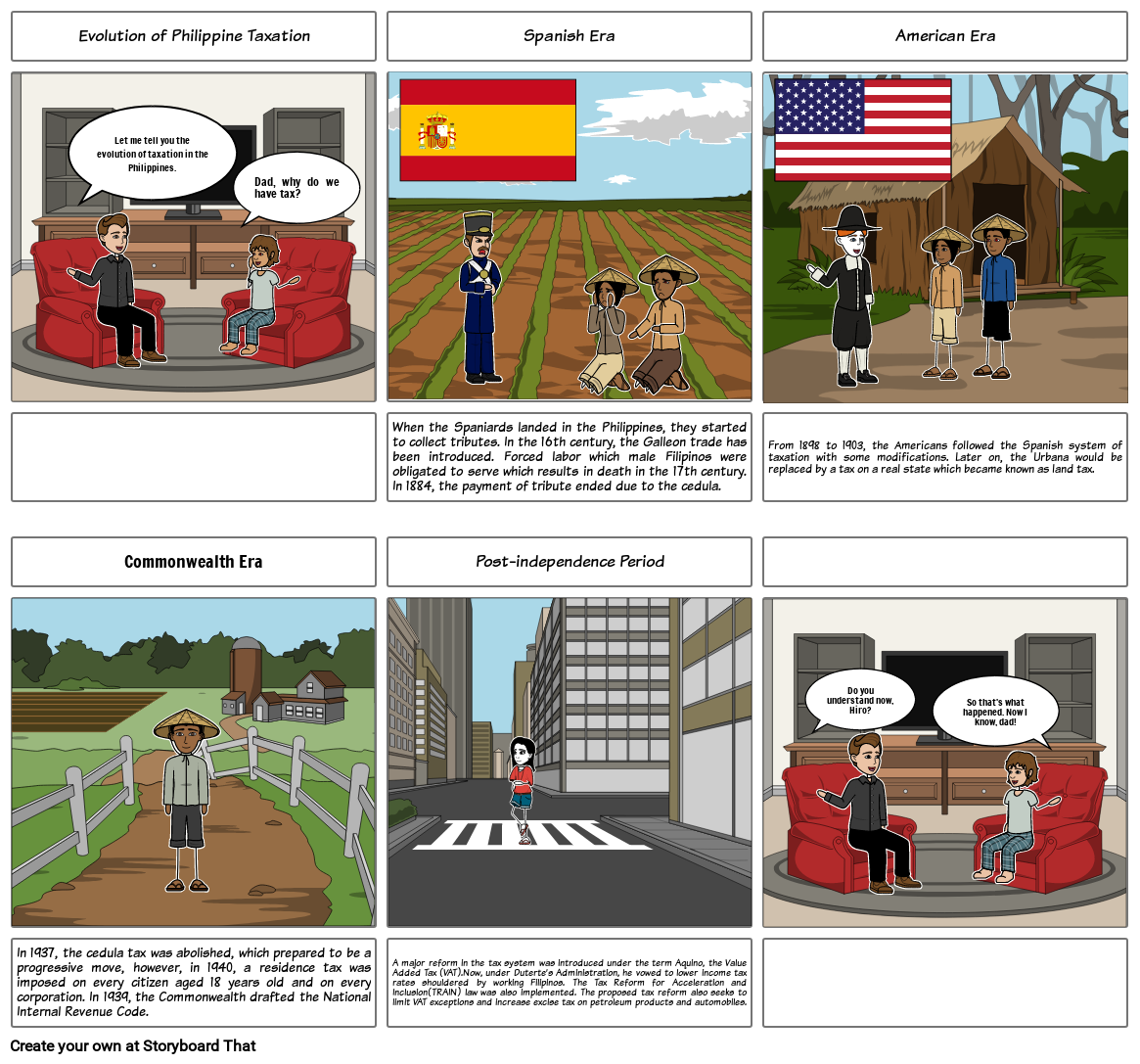

- Evolution of Philippine Taxation

- Let me tell you the evolution of taxation in the Philippines.

- Dad, why do we have tax?

- Spanish Era

- American Era

- Commonwealth Era

- When the Spaniards landed in the Philippines, they started to collect tributes. In the 16th century, the Galleon trade has been introduced. Forced labor which male Filipinos were obligated to serve which results in death in the 17th century. In 1884, the payment of tribute ended due to the cedula.

- Post-independence Period

- From 1898 to 1903, the Americans followed the Spanish system of taxation with some modifications. Later on, the Urbana would be replaced by a tax on a real state which became known as land tax.

- Do you understand now, Hiro?

- So that's what happened. Now I know, dad!

- In 1937, the cedula tax was abolished, which prepared to be a progressive move, however, in 1940, a residence tax was imposed on every citizen aged 18 years old and on every corporation. In 1939, the Commonwealth drafted the National Internal Revenue Code.

- A major reform in the tax system was introduced under the term Aquino, the Value Added Tax (VAT).Now, under Duterte’s Administration, he vowed to lower income tax rates shouldered by working Filipinos. The Tax Reform for Acceleration and Inclusion(TRAIN) law was also implemented. The proposed tax reform also seeks to limit VAT exceptions and increase excise tax on petroleum products and automobiles.

30 मिलियन से अधिक स्टोरीबोर्ड बनाए गए