Pt.2

स्टोरीबोर्ड पाठ

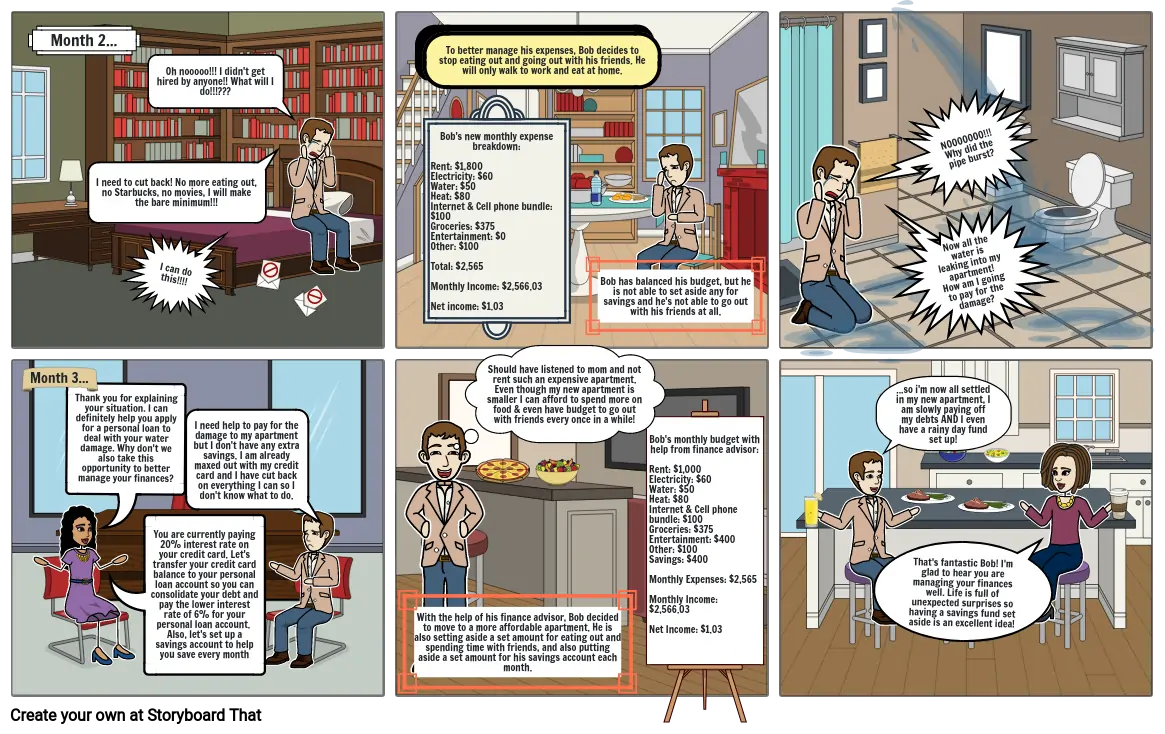

- Month 2...

- I need to cut back! No more eating out, no Starbucks, no movies, I will make the bare minimum!!!

- I can do this!!!!

- Oh nooooo!!! I didn't get hired by anyone!! What will I do!!!???

-

-

- To better manage his expenses, Bob decides to stop eating out and going out with his friends. He will only walk to work and eat at home.

- Bob's new monthly expense breakdown:Rent: $1,800Electricity: $60Water: $50Heat: $80Internet & Cell phone bundle: $100Groceries: $375Entertainment: $0Other: $100Total: $2,565Monthly Income: $2,566.03Net income: $1.03

- Should have listened to mom and not rent such an expensive apartment. Even though my new apartment is smaller I can afford to spend more on food & even have budget to go out with friends every once in a while!

- Bob has balanced his budget, but he is not able to set aside any for savings and he's not able to go out with his friends at all.

- NOOOOOOO!!! Why did the pipe burst?

- Now all the water is leaking into my apartment! How am I going to pay for the damage?

- Month 3...

- Thank you for explaining your situation. I can definitely help you apply for a personal loan to deal with your water damage. Why don't we also take this opportunity to better manage your finances?

- You are currently paying 20% interest rate on your credit card. Let's transfer your credit card balance to your personal loan account so you can consolidate your debt and pay the lower interest rate of 6% for your personal loan account. Also, let's set up a savings account to help you save every month

- I need help to pay for the damage to my apartment but I don't have any extra savings. I am already maxed out with my credit card and I have cut back on everything I can so I don't know what to do.

- With the help of his finance advisor, Bob decided to move to a more affordable apartment. He is also setting aside a set amount for eating out and spending time with friends, and also putting aside a set amount for his savings account each month.

- Bob's monthly budget with help from finance advisor:Rent: $1,000Electricity: $60Water: $50Heat: $80Internet & Cell phone bundle: $100Groceries: $375Entertainment: $400Other: $100Savings: $400Monthly Expenses: $2,565Monthly Income: $2,566.03Net Income: $1.03

- That's fantastic Bob! I'm glad to hear you are managing your finances well. Life is full of unexpected surprises so having a savings fund set aside is an excellent idea!

- ...so i'm now all settled in my new apartment, I am slowly paying off my debts AND I even have a rainy day fund set up!

30 मिलियन से अधिक स्टोरीबोर्ड बनाए गए