Jill and Sue's Progressive Income Taxes

Texte du Storyboard

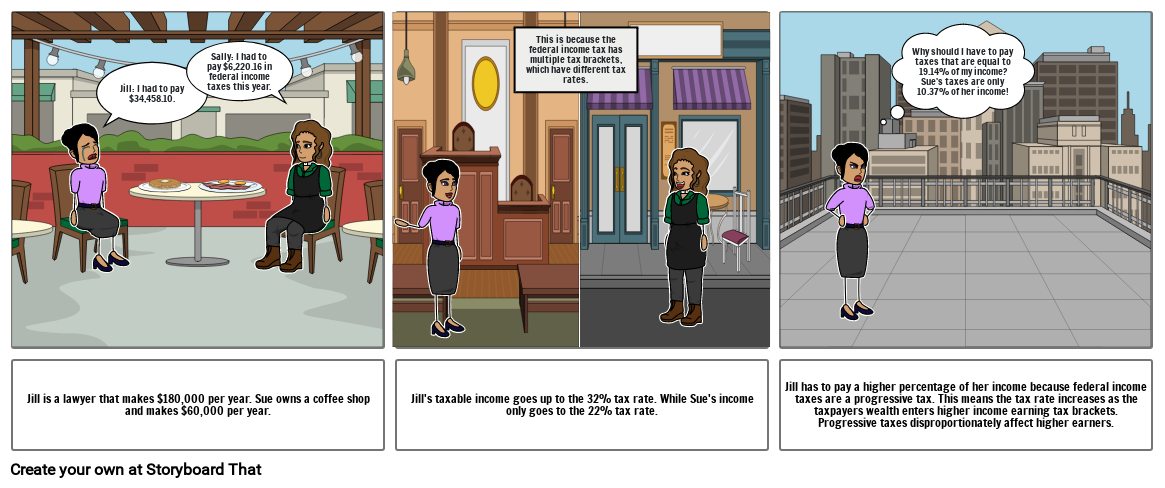

- Jill: I had to pay $34,458.10.

- Sally: I had to pay $6,220.16 in federal income taxes this year.

- This is because the federal income tax has multiple tax brackets, which have different tax rates.

- Why should I have to pay taxes that are equal to 19.14% of my income? Sue's taxes are only 10.37% of her income!

- Jill is a lawyer that makes $180,000 per year. Sue owns a coffee shop and makes $60,000 per year.

- Jill's taxable income goes up to the 32% tax rate. While Sue's income only goes to the 22% tax rate.

- Jill has to pay a higher percentage of her income because federal income taxes are a progressive tax. This means the tax rate increases as the taxpayers wealth enters higher income earning tax brackets. Progressive taxes disproportionately affect higher earners.

Plus de 30 millions de storyboards créés