Great Depression 1

Texte du Storyboard

- Glisser: 1

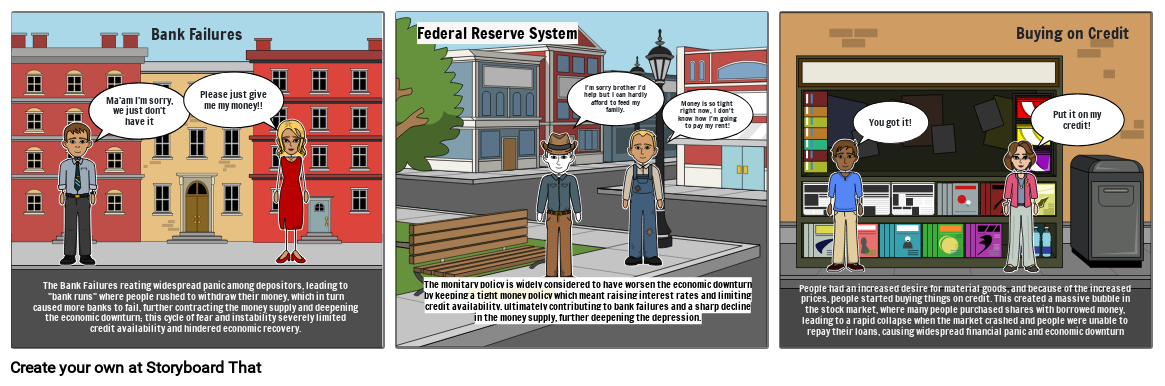

- Bank Failures

- Please just give me my money!!

- Ma'am I'm sorry, we just don't have it

- The Bank Failures reating widespread panic among depositors, leading to "bank runs" where people rushed to withdraw their money, which in turn caused more banks to fail, further contracting the money supply and deepening the economic downturn; this cycle of fear and instability severely limited credit availability and hindered economic recovery.

- Glisser: 2

- Federal Reserve System

- I'm sorry brother I'd help but I can hardly afford to feed my family.

- Money is so tight right now, I don't know how I'm going to pay my rent!

- The monitary policy is widely considered to have worsen the economic downturn by keeping a tight money policy which meant raising interest rates and limiting credit availability, ultimately contributing to bank failures and a sharp decline in the money supply, further deepening the depression.

- Glisser: 3

- Buying on Credit

- Put it on my credit!

- You got it!

- People had an increased desire for material goods, and because of the increased prices, people started buying things on credit. This created a massive bubble in the stock market, where many people purchased shares with borrowed money, leading to a rapid collapse when the market crashed and people were unable to repay their loans, causing widespread financial panic and economic downturn

Plus de 30 millions de storyboards créés