ACF2100 Storyboard

Texte du Storyboard

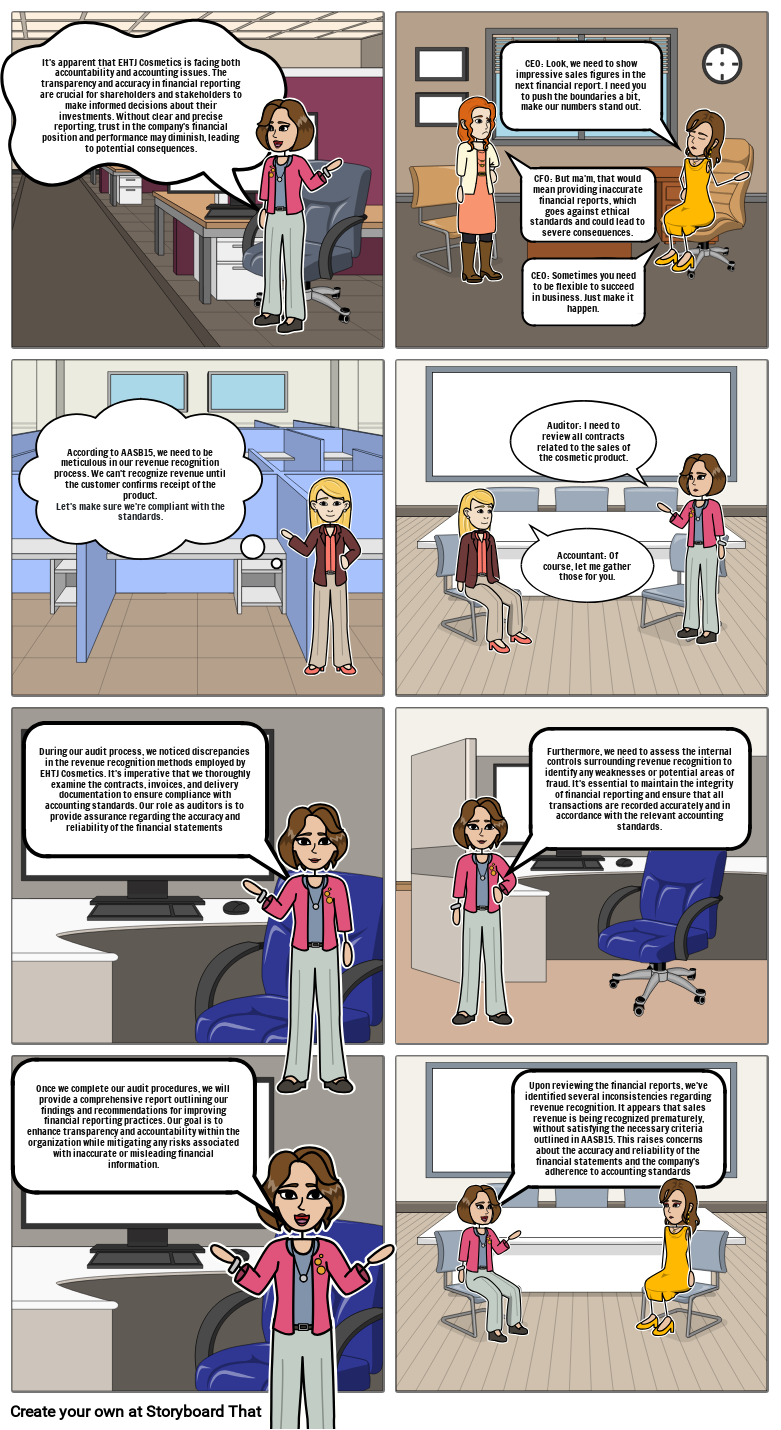

- It's apparent that EHTJ Cosmetics is facing both accountability and accounting issues. The transparency and accuracy in financial reporting are crucial for shareholders and stakeholders to make informed decisions about their investments. Without clear and precise reporting, trust in the company's financial position and performance may diminish, leading to potential consequences.

- CEO: Look, we need to show impressive sales figures in the next financial report. I need you to push the boundaries a bit, make our numbers stand out.

- CFO: But ma'm, that would mean providing inaccurate financial reports, which goes against ethical standards and could lead to severe consequences.

- CEO: Sometimes you need to be flexible to succeed in business. Just make it happen.

- According to AASB15, we need to be meticulous in our revenue recognition process. We can't recognize revenue until the customer confirms receipt of the product.Let's make sure we're compliant with the standards.

- Auditor: I need to review all contracts related to the sales of the cosmetic product.

- Accountant: Of course, let me gather those for you.

- During our audit process, we noticed discrepancies in the revenue recognition methods employed by EHTJ Cosmetics. It's imperative that we thoroughly examine the contracts, invoices, and delivery documentation to ensure compliance with accounting standards. Our role as auditors is to provide assurance regarding the accuracy and reliability of the financial statements

- Furthermore, we need to assess the internal controls surrounding revenue recognition to identify any weaknesses or potential areas of fraud. It's essential to maintain the integrity of financial reporting and ensure that all transactions are recorded accurately and in accordance with the relevant accounting standards.

- Once we complete our audit procedures, we will provide a comprehensive report outlining our findings and recommendations for improving financial reporting practices. Our goal is to enhance transparency and accountability within the organization while mitigating any risks associated with inaccurate or misleading financial information.

- Upon reviewing the financial reports, we've identified several inconsistencies regarding revenue recognition. It appears that sales revenue is being recognized prematurely, without satisfying the necessary criteria outlined in AASB15. This raises concerns about the accuracy and reliability of the financial statements and the company's adherence to accounting standards

Plus de 30 millions de storyboards créés