Unknown Story

Kuvakäsikirjoitus Teksti

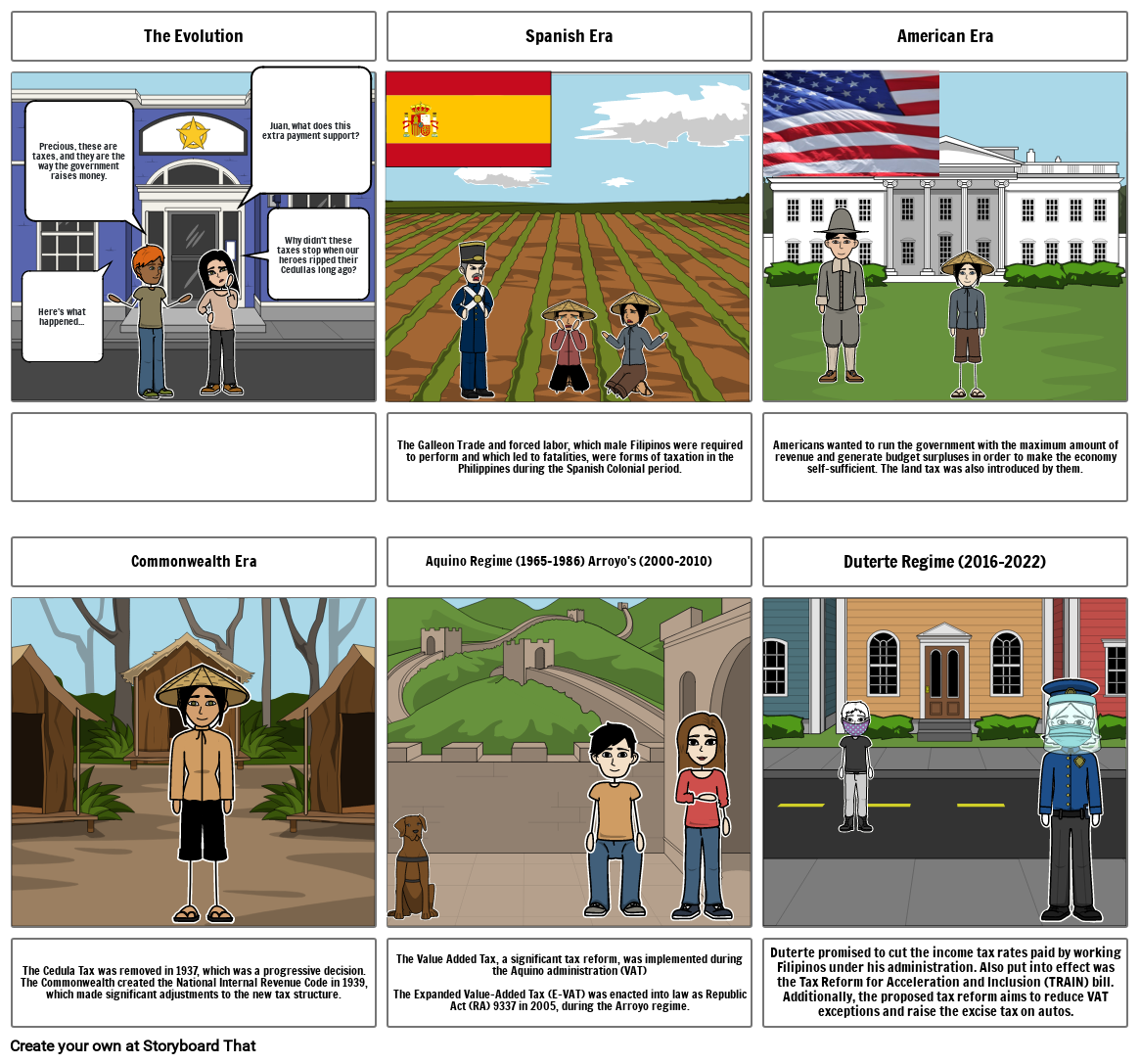

- The Evolution

- Here's what happened...

- Precious, these are taxes, and they are the way the government raises money.

- Juan, what does this extra payment support?

- Why didn't these taxes stop when our heroes ripped their Cedullas long ago?

- Spanish Era

- American Era

- Commonwealth Era

- The Galleon Trade and forced labor, which male Filipinos were required to perform and which led to fatalities, were forms of taxation in the Philippines during the Spanish Colonial period.

- Aquino Regime (1965-1986) Arroyo's (2000-2010)

- Americans wanted to run the government with the maximum amount of revenue and generate budget surpluses in order to make the economy self-sufficient. The land tax was also introduced by them.

- Duterte Regime (2016-2022)

- The Cedula Tax was removed in 1937, which was a progressive decision. The Commonwealth created the National Internal Revenue Code in 1939, which made significant adjustments to the new tax structure.

- The Value Added Tax, a significant tax reform, was implemented during the Aquino administration (VAT)The Expanded Value-Added Tax (E-VAT) was enacted into law as Republic Act (RA) 9337 in 2005, during the Arroyo regime.

- Duterte promised to cut the income tax rates paid by working Filipinos under his administration. Also put into effect was the Tax Reform for Acceleration and Inclusion (TRAIN) bill. Additionally, the proposed tax reform aims to reduce VAT exceptions and raise the excise tax on autos.

Yli 30 miljoonaa kuvakäsikirjoitusta luotu