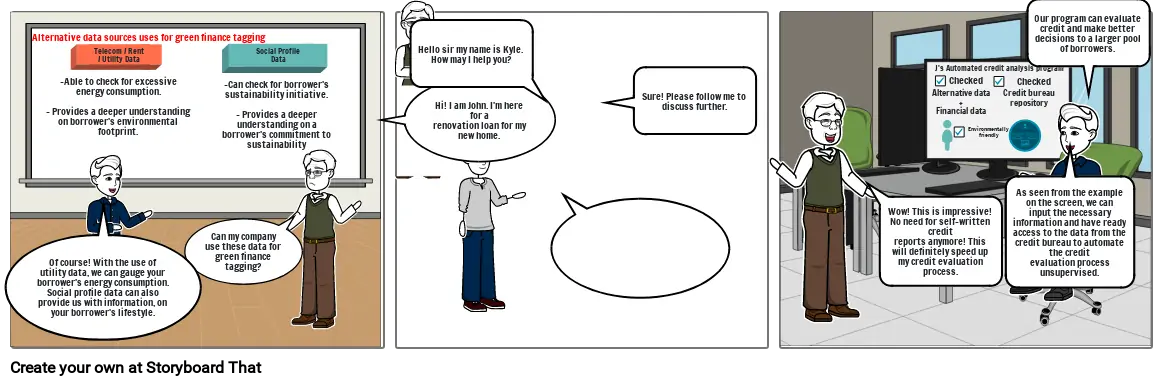

Alternative data sources uses for green finance tagging

Can my company use these data for green finance tagging?

Hi! I am John. I'm here

for a

renovation loan for my new home.

Hello sir my name is Kyle. How may I help you?

Sure! Please follow me to discuss further.

Wow! This is impressive! No need for self-written credit

reports anymore! This will definitely speed up my credit evaluation process.

Of course! With the use of

utility data, we can gauge your borrower's energy consumption. Social profile data can also

provide us with information, on your borrower's lifestyle.

Telecom / Rent / Utility Data

Social Profile Data

-Able to check for excessive

energy consumption.

- Provides a deeper understanding on borrower's environmental footprint.

-Can check for borrower's sustainability initiative.

- Provides a deeper

understanding on a borrower's commitment to sustainability

J's Automated credit analysis program

Our program can evaluate credit and make better decisions to a larger pool of borrowers.

As seen from the example on the screen, we can

input the necessary

information and have ready access to the data from the credit bureau to automate the credit

evaluation process unsupervised.

Alternative data

+

Financial data

Credit bureau repository

Checked

Checked

Environmentally friendly

Alternative data sources uses for green finance tagging

Can my company use these data for green finance tagging?

Hi! I am John. I'm here

for a

renovation loan for my new home.

Hello sir my name is Kyle. How may I help you?

Sure! Please follow me to discuss further.

Wow! This is impressive! No need for self-written credit

reports anymore! This will definitely speed up my credit evaluation process.

Of course! With the use of

utility data, we can gauge your borrower's energy consumption. Social profile data can also

provide us with information, on your borrower's lifestyle.

Telecom / Rent / Utility Data

Social Profile Data

-Able to check for excessive

energy consumption.

- Provides a deeper understanding on borrower's environmental footprint.

-Can check for borrower's sustainability initiative.

- Provides a deeper

understanding on a borrower's commitment to sustainability

J's Automated credit analysis program

Our program can evaluate credit and make better decisions to a larger pool of borrowers.

As seen from the example on the screen, we can

input the necessary

information and have ready access to the data from the credit bureau to automate the credit

evaluation process unsupervised.

Alternative data

+

Financial data

Credit bureau repository

Checked

Checked

Environmentally friendly

Alternative data sources uses for green finance tagging

Can my company use these data for green finance tagging?

Hi! I am John. I'm here

for a

renovation loan for my new home.

Hello sir my name is Kyle. How may I help you?

Sure! Please follow me to discuss further.

Wow! This is impressive! No need for self-written credit

reports anymore! This will definitely speed up my credit evaluation process.

Of course! With the use of

utility data, we can gauge your borrower's energy consumption. Social profile data can also

provide us with information, on your borrower's lifestyle.

Telecom / Rent / Utility Data

Social Profile Data

-Able to check for excessive

energy consumption.

- Provides a deeper understanding on borrower's environmental footprint.

-Can check for borrower's sustainability initiative.

- Provides a deeper

understanding on a borrower's commitment to sustainability

J's Automated credit analysis program

Our program can evaluate credit and make better decisions to a larger pool of borrowers.

As seen from the example on the screen, we can

input the necessary

information and have ready access to the data from the credit bureau to automate the credit

evaluation process unsupervised.

Alternative data

+

Financial data

Credit bureau repository

Checked

Checked

Environmentally friendly

Alternative data sources uses for green finance tagging

Can my company use these data for green finance tagging?

Hi! I am John. I'm here

for a

renovation loan for my new home.

Hello sir my name is Kyle. How may I help you?

Sure! Please follow me to discuss further.

Wow! This is impressive! No need for self-written credit

reports anymore! This will definitely speed up my credit evaluation process.

Of course! With the use of

utility data, we can gauge your borrower's energy consumption. Social profile data can also

provide us with information, on your borrower's lifestyle.

Telecom / Rent / Utility Data

Social Profile Data

-Able to check for excessive

energy consumption.

- Provides a deeper understanding on borrower's environmental footprint.

-Can check for borrower's sustainability initiative.

- Provides a deeper

understanding on a borrower's commitment to sustainability

J's Automated credit analysis program

Our program can evaluate credit and make better decisions to a larger pool of borrowers.

As seen from the example on the screen, we can

input the necessary

information and have ready access to the data from the credit bureau to automate the credit

evaluation process unsupervised.

Alternative data

+

Financial data

Credit bureau repository

Checked

Checked

Environmentally friendly

Kuvakäsikirjoitus Teksti

- Of course! With the use of utility data, we can gauge your borrower's energy consumption. Social profile data can also provide us with information, on your borrower's lifestyle.

- Alternative data sources uses for green finance tagging

- -Able to check for excessive energy consumption.- Provides a deeper understanding on borrower's environmental footprint.

- Telecom / Rent / Utility Data

- Can my company use these data for green finance tagging?

- -Can check for borrower's sustainability initiative.- Provides a deeper understanding on a borrower's commitment to sustainability

- Social Profile Data

- Hi! I am John. I'm herefor a renovation loan for my new home.

- Hello sir my name is Kyle. How may I help you?

- Sure! Please follow me to discuss further.

- Wow! This is impressive! No need for self-written credit reports anymore! This will definitely speed up my credit evaluation process.

- J's Automated credit analysis program

- Alternative data+Financial data

- Checked

- Environmentally friendly

- Credit bureau repository

- Checked

- As seen from the example on the screen, we can input the necessaryinformation and have ready access to the data from the credit bureau to automate the credit evaluation process unsupervised.

- Our program can evaluate credit and make better decisions to a larger pool of borrowers.