Ferlaino v The Queen 2016 TCC 105; 2017 FCA 105

Süžeeskeem Tekst

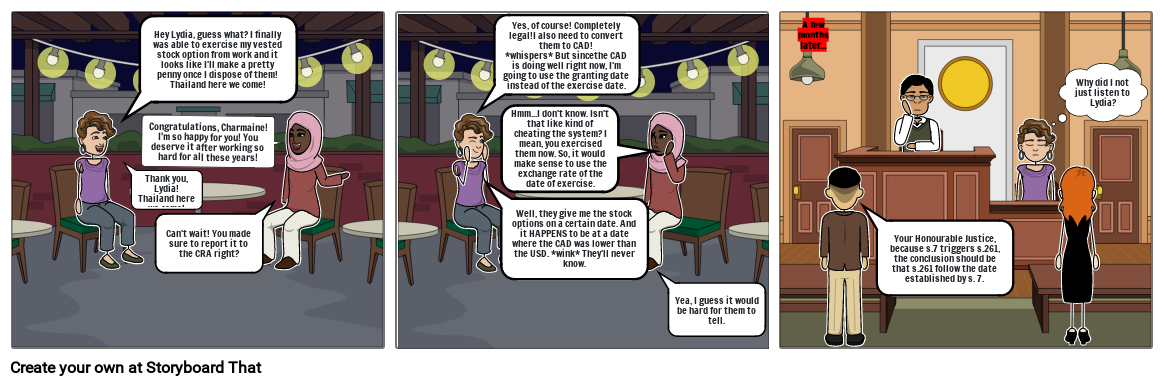

- Hey Lydia, guess what? I finally was able to exercise my vested stock option from work and it looks like I'll make a pretty penny once I dispose of them! Thailand here we come!

- Thank you, Lydia! Thailand here we come!

- Can't wait! You made sure to report it to the CRA right?

- Congratulations, Charmaine! I'm so happy for you! You deserve it after working so hard for all these years!

- Yes, of course! Completely legal!I also need to convert them to CAD!*whispers* But sincethe CAD is doing well right now, I'm going to use the granting date instead of the exercise date.

- Well, they give me the stock options on a certain date. And it HAPPENS to be at a date where the CAD was lower than the USD. *wink* They'll never know.

- Hmm...I don't know. Isn't that like kind of cheating the system? I mean, you exercised them now. So, it would make sense to use the exchange rate of the date of exercise.

- Yea, I guess it would be hard for them to tell.

- A few months later...

- Your Honourable Justice, because s.7 triggers s.261, the conclusion should be that s.261 follow the date established by s. 7.

- Why did I not just listen to Lydia?

Loodud üle 30 miljoni süžeeskeemi