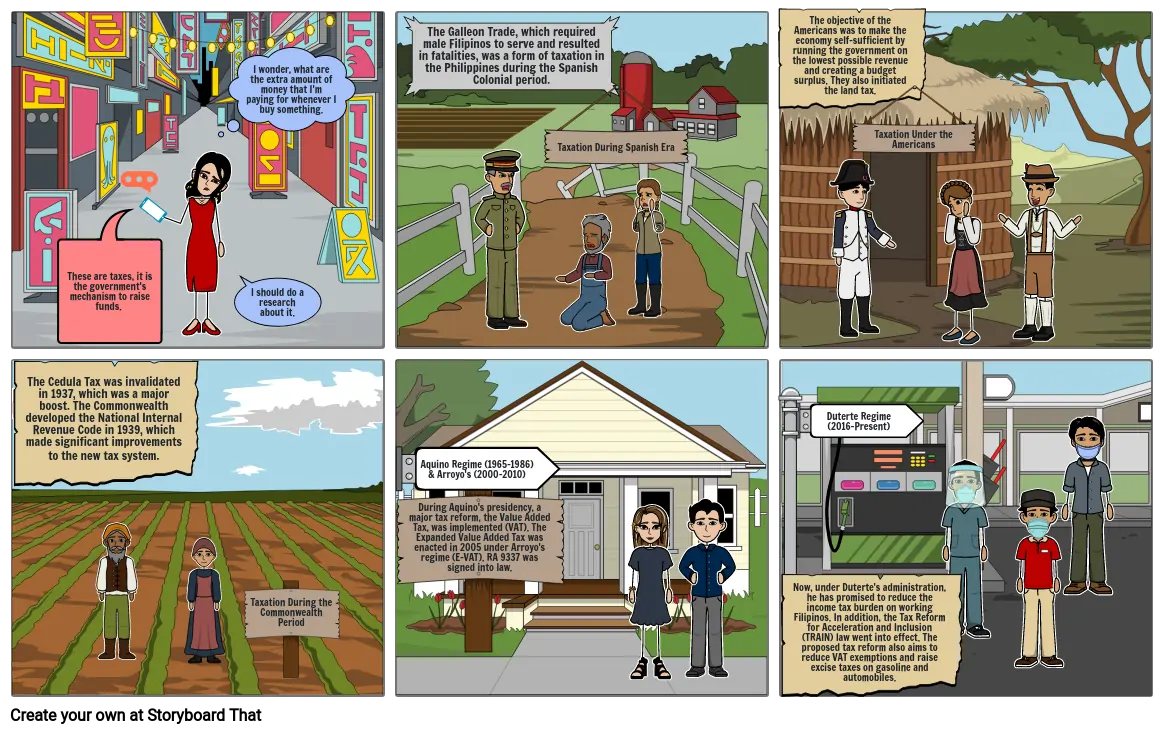

Evolution of the Philippine Taxation

Texto del Guión Gráfico

- These are taxes, it is the government's mechanism to raise funds.

- I wonder, what are the extra amount of money that I'm paying for whenever I buy something.

- I should do a research about it.

- The Galleon Trade, which required male Filipinos to serve and resulted in fatalities, was a form of taxation in the Philippines during the Spanish Colonial period.

- Taxation During Spanish Era

- The objective of the Americans was to make the economy self-sufficient by running the government on the lowest possible revenue and creating a budget surplus. They also initiated the land tax.

- Taxation Under the Americans

- The Cedula Tax was invalidated in 1937, which was a major boost. The Commonwealth developed the National Internal Revenue Code in 1939, which made significant improvements to the new tax system.

- Taxation During the Commonwealth Period

- During Aquino's presidency, a major tax reform, the Value Added Tax, was implemented (VAT). The Expanded Value Added Tax was enacted in 2005 under Arroyo's regime (E-VAT). RA 9337 was signed into law.

- Aquino Regime (1965-1986) & Arroyo's (2000-2010)

- Duterte Regime (2016-Present)

- Now, under Duterte's administration, he has promised to reduce the income tax burden on working Filipinos. In addition, the Tax Reform for Acceleration and Inclusion (TRAIN) law went into effect. The proposed tax reform also aims to reduce VAT exemptions and raise excise taxes on gasoline and automobiles.

Más de 30 millones de guiones gráficos creados