Gifts

Texto del Guión Gráfico

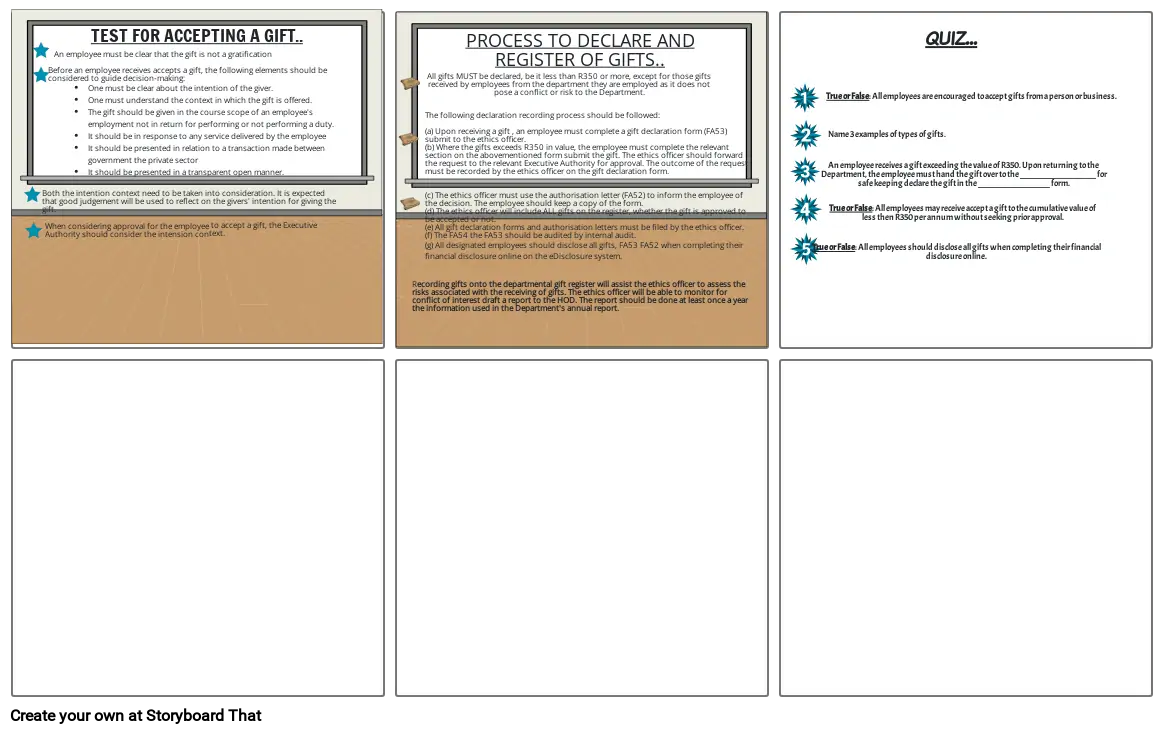

- Before an employee receives accepts a gift, the following elements should be considered to guide decision-making:One must be clear about the intention of the giver. One must understand the context in which the gift is offered. The gift should be given in the course scope of an employee's employment not in return for performing or not performing a duty. It should be in response to any service delivered by the employeeIt should be presented in relation to a transaction made between government the private sector It should be presented in a transparent open manner.

- An employee must be clear that the gift is not a gratification

- Both the intention context need to be taken into consideration. It is expected that good judgement will be used to reflect on the givers' intention for giving the gift.

- When considering approval for the employee to accept a gift, the Executive Authority should consider the intension context.

- TEST FOR ACCEPTING A GIFT..

- Recording gifts onto the departmental gift register will assist the ethics officer to assess the risks associated with the receiving of gifts. The ethics officer will be able to monitor for conflict of interest draft a report to the HOD. The report should be done at least once a year the information used in the Department's annual report.

- All gifts MUST be declared, be it less than R350 or more, except for those gifts received by employees from the department they are employed as it does not pose a conflict or risk to the Department.

- The following declaration recording process should be followed:(a) Upon receiving a gift , an employee must complete a gift declaration form (FA53) submit to the ethics officer.(b) Where the gifts exceeds R350 in value, the employee must complete the relevant section on the abovementioned form submit the gift. The ethics officer should forward the request to the relevant Executive Authority for approval. The outcome of the request must be recorded by the ethics officer on the gift declaration form.(c) The ethics officer must use the authorisation letter (FA52) to inform the employee of the decision. The employee should keep a copy of the form.(d) The ethics officer will include ALL gifts on the register, whether the gift is approved to be accepted or not.(e) All gift declaration forms and authorisation letters must be filed by the ethics officer.(f) The FA54 the FA53 should be audited by internal audit.(g) All designated employees should disclose all gifts, FA53 FA52 when completing their financial disclosure online on the eDisclosure system.

- PROCESS TO DECLARE AND REGISTER OF GIFTS..

- True or False: All employees should disclose all gifts when completing their financial disclosure online.

- Name 3 examples of types of gifts.

- An employee receives a gift exceeding the value of R350. Upon returning to the Department, the employee must hand the gift over to the ___________________ for safe keeping declare the gift in the __________________ form.

- True or False: All employees are encouraged to accept gifts from a person or business.

- True or False: All employees may receive accept a gift to the cumulative value of less then R350 per annum without seeking prior approval.

- QUIZ...

Más de 30 millones de guiones gráficos creados