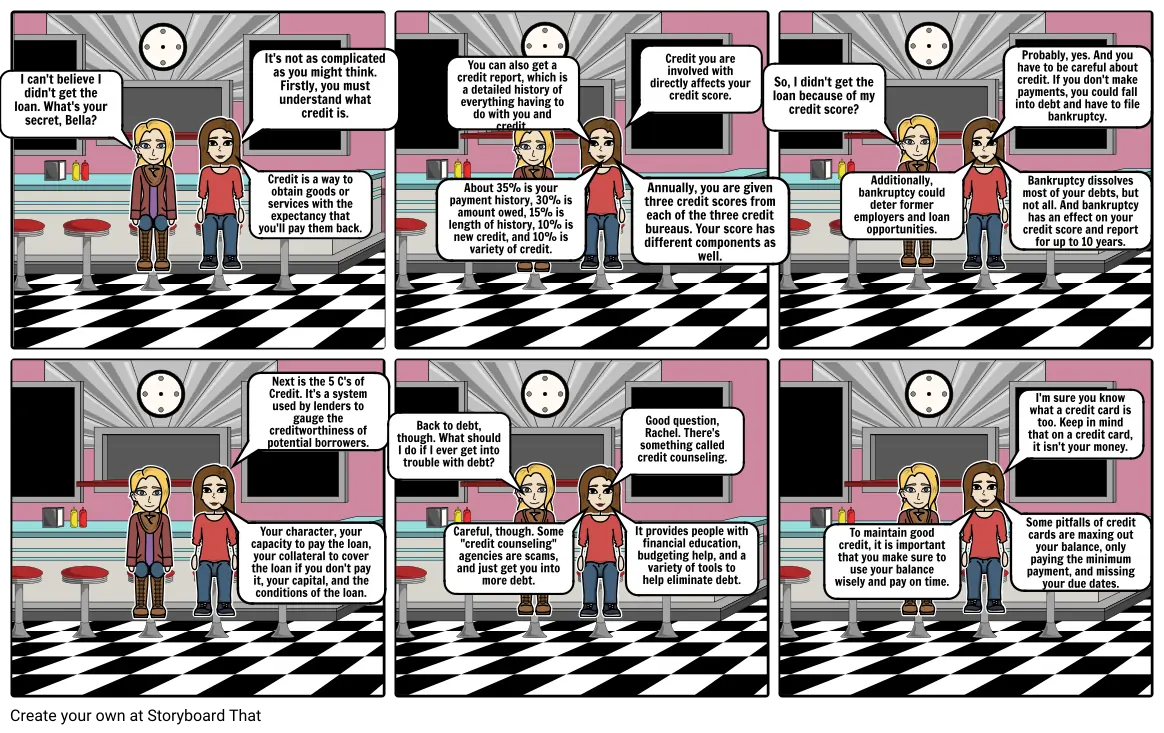

Personal Finance

Texto del Guión Gráfico

- I can't believe I didn't get the loan. What's your secret, Bella?

- It's not as complicated as you might think. Firstly, you must understand what credit is.

- Credit is a way to obtain goods or services with the expectancy that you'll pay them back.

- About 35% is your payment history, 30% is amount owed, 15% is length of history, 10% is new credit, and 10% is variety of credit.

- You can also get a credit report, which is a detailed history of everything having to do with you and credit.

- Annually, you are given three credit scores from each of the three credit bureaus. Your score has different components as well.

- Credit you are involved with directly affects your credit score.

- So, I didn't get the loan because of my credit score?

- Additionally, bankruptcy could deter former employers and loan opportunities.

- Probably, yes. And you have to be careful about credit. If you don't make payments, you could fall into debt and have to file bankruptcy.

- Bankruptcy dissolves most of your debts, but not all. And bankruptcy has an effect on your credit score and report for up to 10 years.

- Your character, your capacity to pay the loan, your collateral to cover the loan if you don't pay it, your capital, and the conditions of the loan.

- Next is the 5 C's of Credit. It's a system used by lenders to gauge the creditworthiness of potential borrowers.

- Back to debt, though. What should I do if I ever get into trouble with debt?

- Careful, though. Some "credit counseling" agencies are scams, and just get you into more debt.

- Good question, Rachel. There's something called credit counseling.

- It provides people with financial education, budgeting help, and a variety of tools to help eliminate debt.

- To maintain good credit, it is important that you make sure to use your balance wisely and pay on time.

- Some pitfalls of credit cards are maxing out your balance, only paying the minimum payment, and missing your due dates.

- I'm sure you know what a credit card is too. Keep in mind that on a credit card, it isn't your money.

Más de 30 millones de guiones gráficos creados