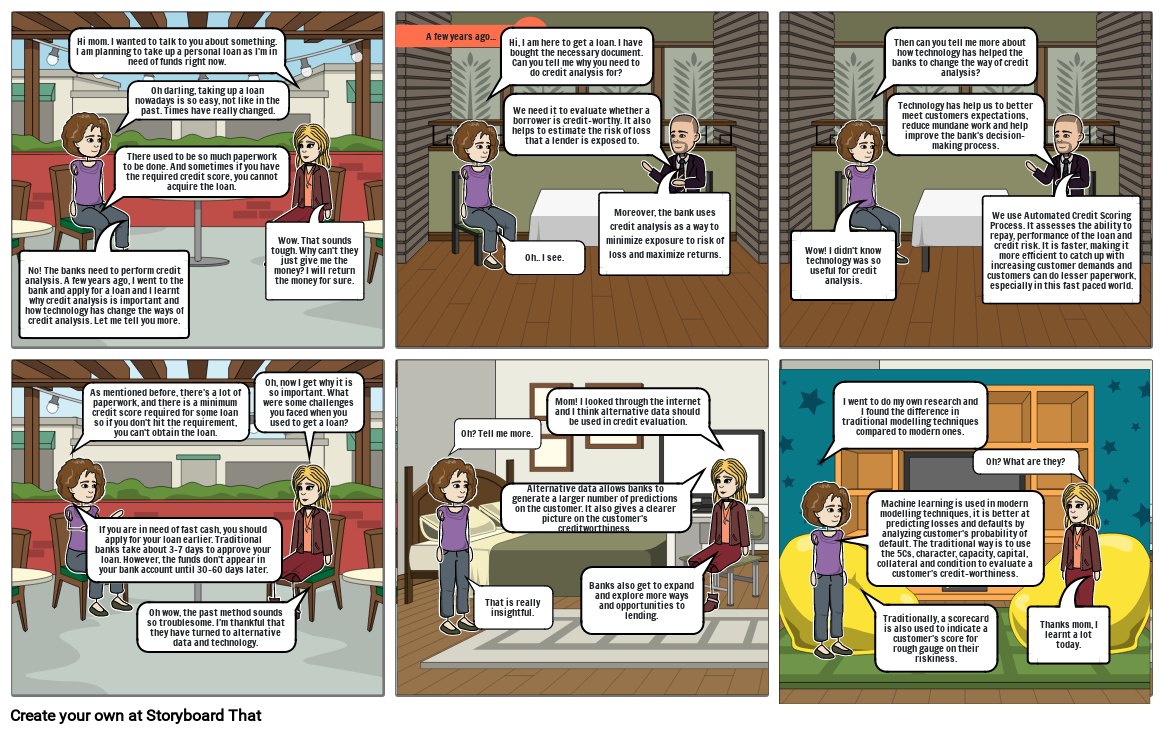

Credit 'Comic'

Storyboard-Text

- No! The banks need to perform credit analysis. A few years ago, I went to the bank and apply for a loan and I learnt why credit analysis is important and how technology has change the ways of credit analysis. Let me tell you more.

- Hi mom. I wanted to talk to you about something. I am planning to take up a personal loan as I'm in need of funds right now.

- There used to be so much paperwork to be done. And sometimes if you have the required credit score, you cannot acquire the loan.

- Oh darling, taking up a loan nowadays is so easy, not like in the past. Times have really changed.

- Wow. That sounds tough. Why can't they just give me the money? I will return the money for sure.

- A few years ago...

- Hi, I am here to get a loan. I have bought the necessary document. Can you tell me why you need to do credit analysis for?

- Oh.. I see.

- We need it to evaluate whether a borrower is credit-worthy. It also helps to estimate the risk of loss that a lender is exposed to.

- Moreover, the bank uses credit analysis as a way to minimize exposure to risk of loss and maximize returns.

- Wow! I didn't know technology was so useful for credit analysis.

- Then can you tell me more about how technology has helped the banks to change the way of credit analysis?

- Technology has help us to better meet customers expectations, reduce mundane work and help improve the bank's decision-making process.

- We use Automated Credit Scoring Process. It assesses the ability to repay, performance of the loan and credit risk. It is faster, making it more efficient to catch up with increasing customer demands and customers can do lesser paperwork, especially in this fast paced world.

- As mentioned before, there's a lot of paperwork, and there is a minimum credit score required for some loan so if you don't hit the requirement, you can't obtain the loan.

- If you are in need of fast cash, you should apply for your loan earlier. Traditional banks take about 3-7 days to approve your loan. However, the funds don't appear in your bank account until 30-60 days later.

- Oh wow, the past method sounds so troublesome. I'm thankful that they have turned to alternative data and technology.

- Oh, now I get why it is so important. What were some challenges you faced when you used to get a loan?

- Oh? Tell me more.

- That is really insightful.

- Alternative data allows banks to generate a larger number of predictions on the customer. It also gives a clearer picture on the customer's creditworthiness.

- Mom! I looked through the internet and I think alternative data should be used in credit evaluation.

- Banks also get to expand and explore more ways and opportunities to lending.

- I went to do my own research and I found the difference in traditional modelling techniques compared to modern ones.

- Machine learning is used in modern modelling techniques, it is better at predicting losses and defaults by analyzing customer's probability of default. The traditional way is to use the 5Cs, character, capacity, capital, collateral and condition to evaluate a customer's credit-worthiness.

- Traditionally, a scorecard is also used to indicate a customer's score for rough gauge on their riskiness.

- Oh? What are they?

- Thanks mom, I learnt a lot today.

Über 30 Millionen erstellte Storyboards