Storyboard Tekst

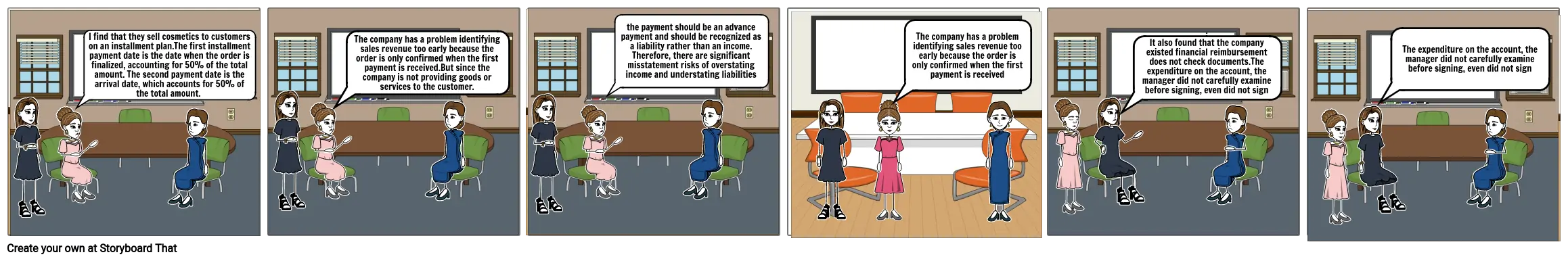

- I find that they sell cosmetics to customers on an installment plan.The first installment payment date is the date when the order is finalized, accounting for 50% of the total amount. The second payment date is the arrival date, which accounts for 50% of the total amount.

- The company has a problem identifying sales revenue too early because the order is only confirmed when the first payment is received.But since the company is not providing goods or services to the customer.

- the payment should be an advance payment and should be recognized as a liability rather than an income. Therefore, there are significant misstatement risks of overstating income and understating liabilities

- The company has a problem identifying sales revenue too early because the order is only confirmed when the first payment is received

- :It also found that the company existed financial reimbursement does not check documents.The expenditure on the account, the manager did not carefully examine before signing, even did not sign

- The expenditure on the account, the manager did not carefully examine before signing, even did not sign

Over 30 millioner Storyboards oprettet