Storyboard

Storyboard Tekst

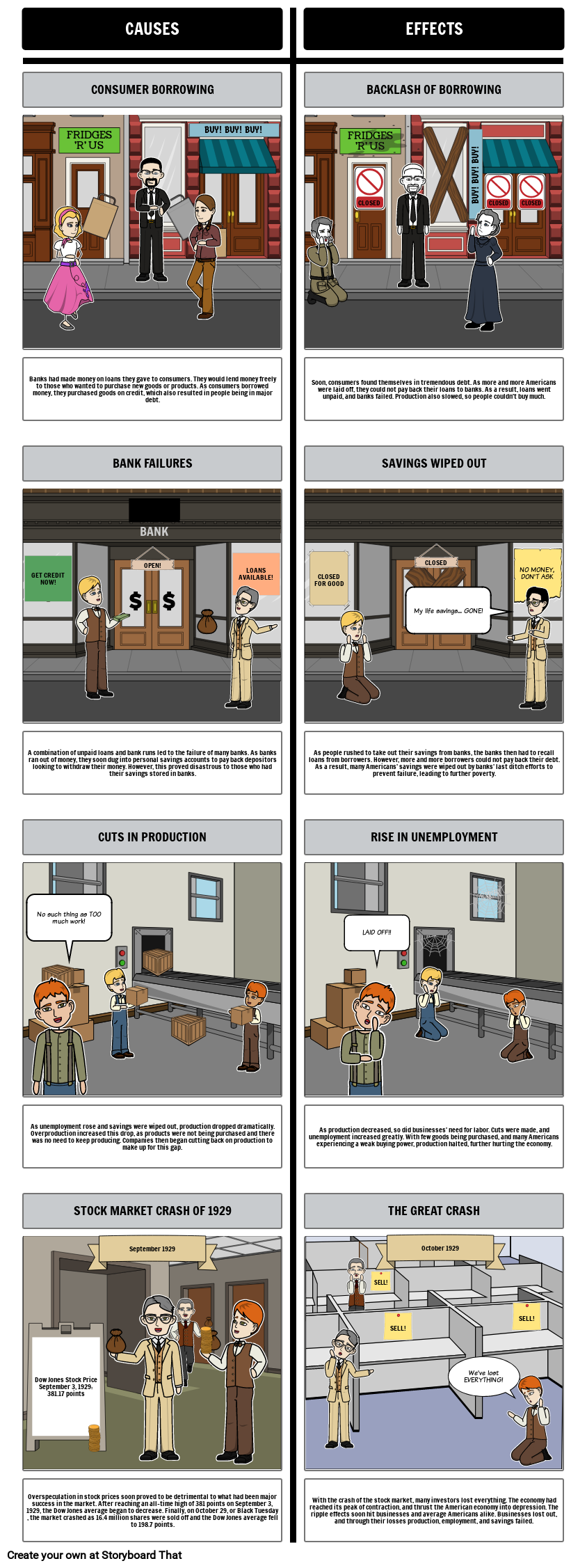

- CONSUMER BORROWING

- CAUSES

- FRIDGES 'R' US

- BUY! BUY! BUY!

- BACKLASH OF BORROWING

- EFFECTS

- FRIDGES 'R' US

- CLOSED

- BUY! BUY! BUY!

- CLOSED

- CLOSED

- Banks had made money on loans they gave to consumers. They would lend money freely to those who wanted to purchase new goods or products. As consumers borrowed money, they purchased goods on credit, which also resulted in people being in major debt.

- BANK FAILURES

- Soon, consumers found themselves in tremendous debt. As more and more Americans were laid off, they could not pay back their loans to banks. As a result, loans went unpaid, and banks failed. Production also slowed, so people couldn't buy much.

- SAVINGS WIPED OUT

- GET CREDIT NOW!

- OPEN!

- BANK

- LOANS AVAILABLE!

- CLOSED FOR GOOD

- CLOSED

- NO MONEY, DON'T ASK

- My life savings... GONE!

- A combination of unpaid loans and bank runs led to the failure of many banks. As banks ran out of money, they soon dug into personal savings accounts to pay back depositors looking to withdraw their money. However, this proved disastrous to those who had their savings stored in banks.

- CUTS IN PRODUCTION

- No such thing as TOO much work!

- As people rushed to take out their savings from banks, the banks then had to recall loans from borrowers. However, more and more borrowers could not pay back their debt. As a result, many Americans' savings were wiped out by banks' last ditch efforts to prevent failure, leading to further poverty.

- RISE IN UNEMPLOYMENT

- LAID OFF!!

- As unemployment rose and savings were wiped out, production dropped dramatically. Overproduction increased this drop, as products were not being purchased and there was no need to keep producing. Companies then began cutting back on production to make up for this gap.

- STOCK MARKET CRASH OF 1929

- As production decreased, so did businesses' need for labor. Cuts were made, and unemployment increased greatly. With few goods being purchased, and many Americans experiencing a weak buying power, production halted, further hurting the economy.

- THE GREAT CRASH

- Dow Jones Stock Price September 3, 1929:381.17 points

- September 1929

- SELL!

- October 1929

- SELL!

- We've lost EVERYTHING!

- SELL!

- Overspeculation in stock prices soon proved to be detrimental to what had been major success in the market. After reaching an all-time high of 381 points on September 3, 1929, the Dow Jones average began to decrease. Finally, on October 29, or Black Tuesday, the market crashed as 16.4 million shares were sold off and the Dow Jones average fell to 198.7 points.

- With the crash of the stock market, many investors lost everything. The economy had reached its peak of contraction, and thrust the American economy into depression. The ripple effects soon hit businesses and average Americans alike. Businesses lost out, and through their losses production, employment, and savings failed.

Over 30 millioner Storyboards oprettet