Asset Management

Storyboard Tekst

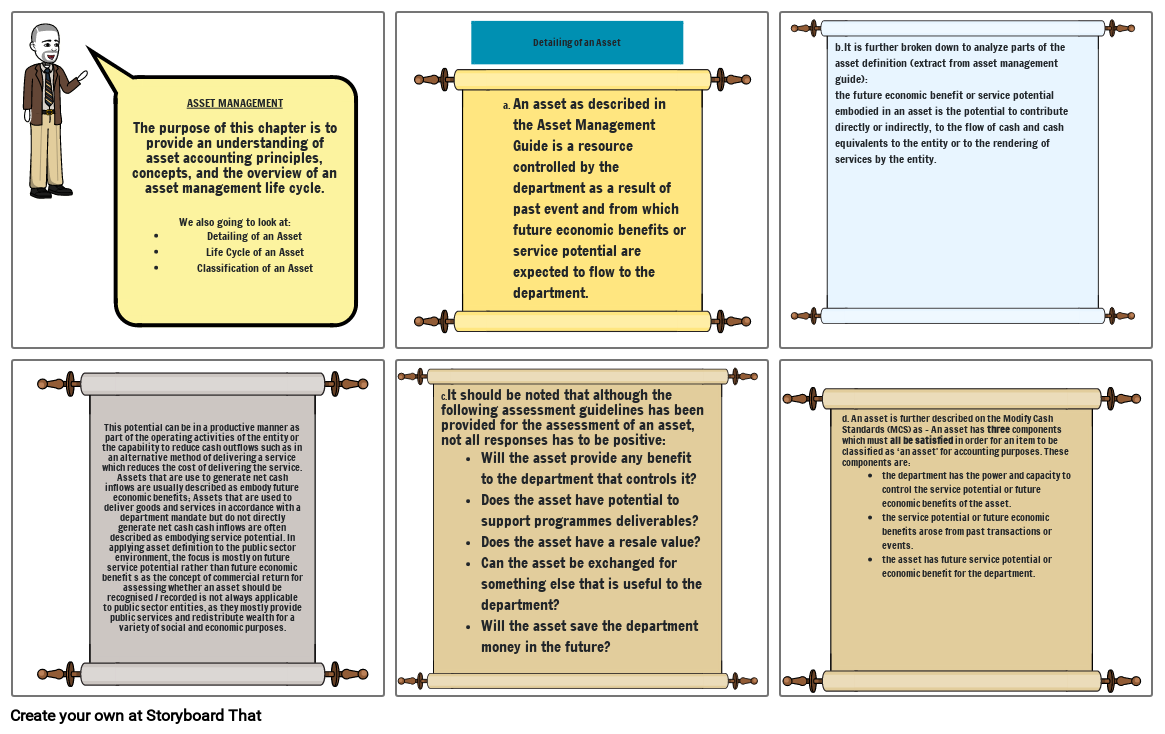

- ASSET MANAGEMENTThe purpose of this chapter is to provide an understanding of asset accounting principles, concepts, and the overview of an asset management life cycle.We also going to look at:Detailing of an AssetLife Cycle of an AssetClassification of an Asset

- An asset as described in the Asset Management Guide is a resource controlled by the department as a result of past event and from which future economic benefits or service potential are expected to flow to the department.

- Detailing of an Asset

- b.It is further broken down to analyze parts of the asset definition (extract from asset management guide):the future economic benefit or service potential embodied in an asset is the potential to contribute directly or indirectly, to the flow of cash and cash equivalents to the entity or to the rendering of services by the entity.

- This potential can be in a productive manner as part of the operating activities of the entity or the capability to reduce cash outflows such as in an alternative method of delivering a service which reduces the cost of delivering the service. Assets that are use to generate net cash inflows are usually described as embody future economic benefits; Assets that are used to deliver goods and services in accordance with a department mandate but do not directly generate net cash cash inflows are often described as embodying service potential. In applying asset definition to the public sector environment, the focus is mostly on future service potential rather than future economic benefit s as the concept of commercial return for assessing whether an asset should be recognised / recorded is not always applicable to public sector entities, as they mostly provide public services and redistribute wealth for a variety of social and economic purposes.

- c.It should be noted that although the following assessment guidelines has been provided for the assessment of an asset, not all responses has to be positive:Will the asset provide any benefit to the department that controls it?Does the asset have potential to support programmes deliverables?Does the asset have a resale value?Can the asset be exchanged for something else that is useful to the department?Will the asset save the department money in the future?

- d. An asset is further described on the Modify Cash Standards (MCS) as – An asset has three components which must all be satisfied in order for an item to be classified as ‘an asset' for accounting purposes. These components are:the department has the power and capacity to control the service potential or future economic benefits of the asset.the service potential or future economic benefits arose from past transactions or events.the asset has future service potential or economic benefit for the department.

Over 30 millioner Storyboards oprettet