important work

Текст на Статията

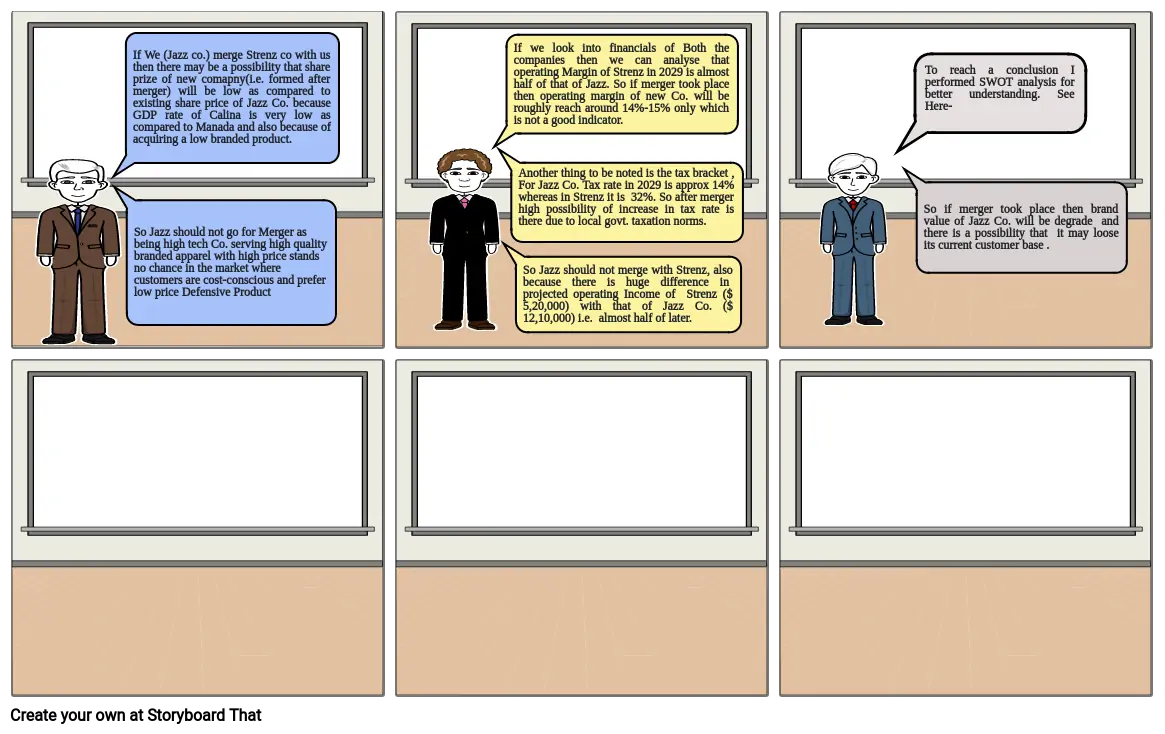

- If We (Jazz co.) merge Strenz co with us then there may be a possibility that share prize of new comapny(i.e. formed after merger) will be low as compared to existing share price of Jazz Co. because GDP rate of Calina is very low as compared to Manada and also because of acquiring a low branded product.

- So Jazz should not go for Merger as being high tech Co. serving high quality branded apparel with high price stands no chance in the market where customers are cost-conscious and prefer low price Defensive Product

- If we look into financials of Both the companies then we can analyse that operating Margin of Strenz in 2029 is almost half of that of Jazz. So if merger took place then operating margin of new Co. will be roughly reach around 14%-15% only which is not a good indicator.

- Another thing to be noted is the tax bracket , For Jazz Co. Tax rate in 2029 is approx 14% whereas in Strenz it is 32%. So after merger high possibility of increase in tax rate is there due to local govt. taxation norms.

- So Jazz should not merge with Strenz, also because there is huge difference in projected operating Income of Strenz ($ 5,20,000) with that of Jazz Co. ($ 12,10,000) i.e. almost half of later.

- To reach a conclusion I performed SWOT analysis for better understanding. See Here-

- So if merger took place then brand value of Jazz Co. will be degrade and there is a possibility that it may loose its current customer base .

Над 30 милиона създадени разкадровки