Evolution of Philippine Taxation

نص القصة المصورة

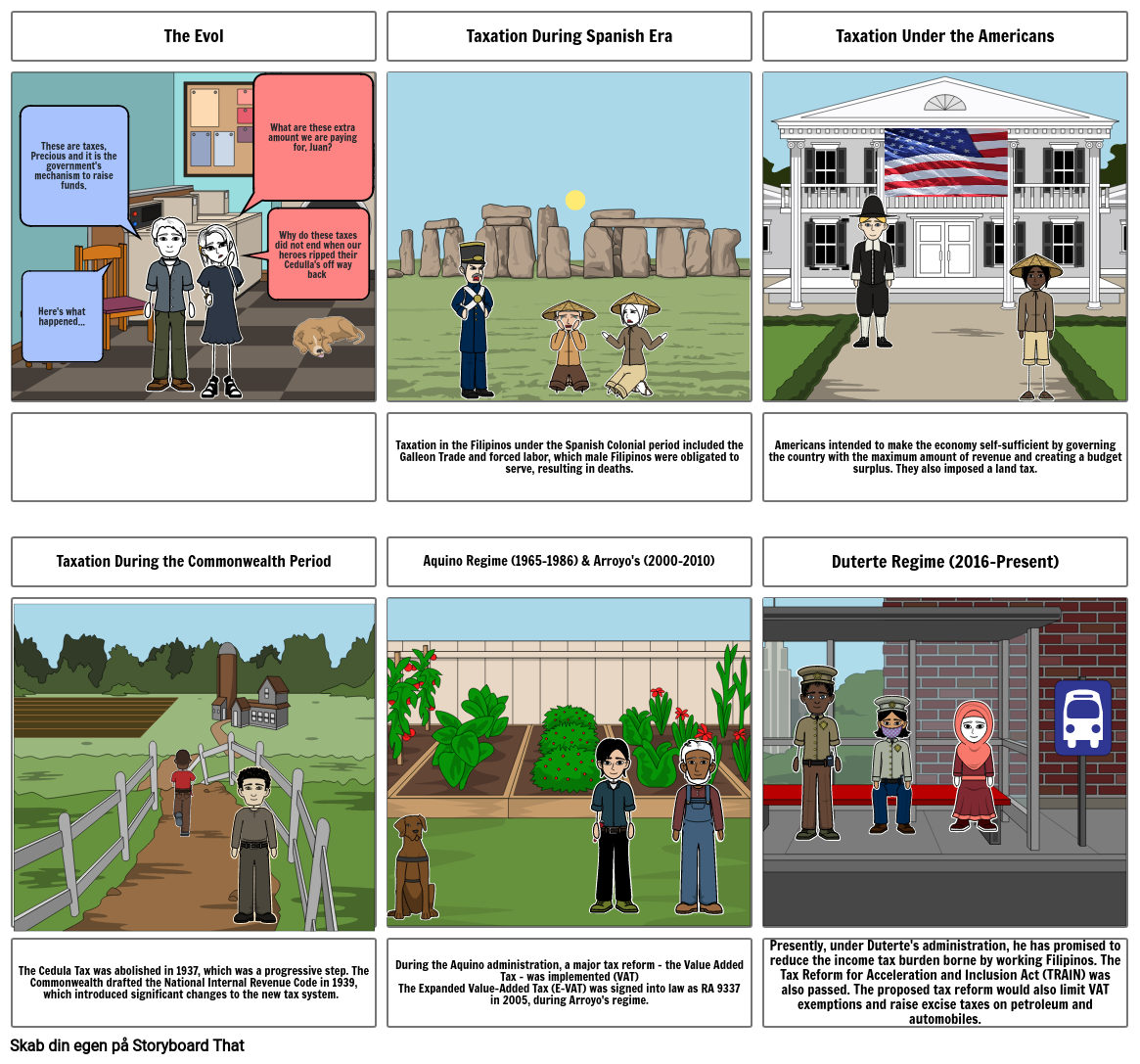

- The Evol

- These are taxes, Precious and it is the government's mechanism to raise funds.

- Here's what happened...

- What are these extra amount we are paying for, Juan?

- Why do these taxes did not end when our heroes ripped their Cedulla's off way back

- Taxation During Spanish Era

- Taxation Under the Americans

- Taxation During the Commonwealth Period

- Taxation in the Filipinos under the Spanish Colonial period included the Galleon Trade and forced labor, which male Filipinos were obligated to serve, resulting in deaths.

- Aquino Regime (1965-1986) & Arroyo's (2000-2010)

- Americans intended to make the economy self-sufficient by governing the country with the maximum amount of revenue and creating a budget surplus. They also imposed a land tax.

- Duterte Regime (2016-Present)

- The Cedula Tax was abolished in 1937, which was a progressive step. The Commonwealth drafted the National Internal Revenue Code in 1939, which introduced significant changes to the new tax system.

- During the Aquino administration, a major tax reform - the Value Added Tax - was implemented (VAT)The Expanded Value-Added Tax (E-VAT) was signed into law as RA 9337 in 2005, during Arroyo's regime.

- Presently, under Duterte's administration, he has promised to reduce the income tax burden borne by working Filipinos. The Tax Reform for Acceleration and Inclusion Act (TRAIN) was also passed. The proposed tax reform would also limit VAT exemptions and raise excise taxes on petroleum and automobiles.

تم إنشاء أكثر من 30 مليون من القصص المصورة