House

نص القصة المصورة

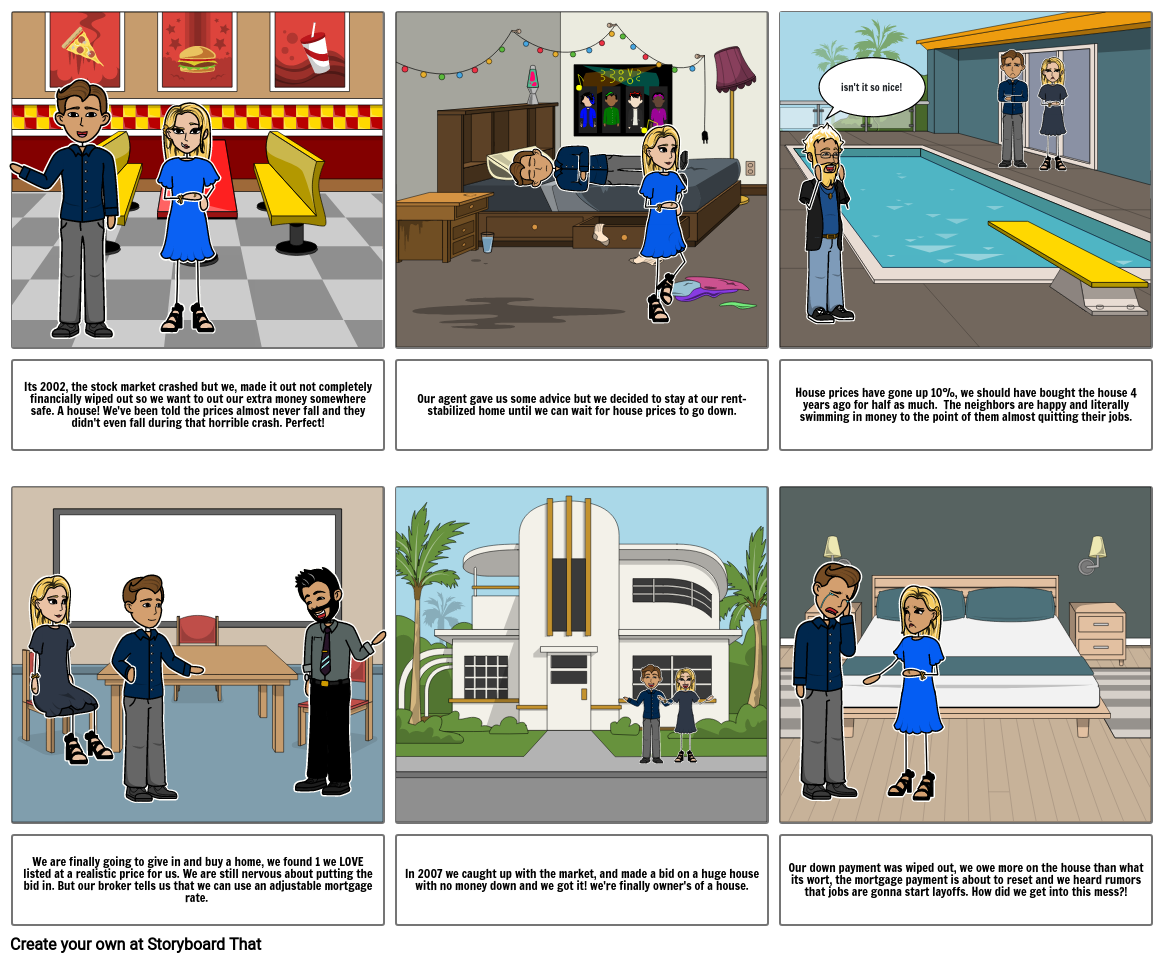

- isn't it so nice!

- Its 2002, the stock market crashed but we, made it out not completely financially wiped out so we want to out our extra money somewhere safe. A house! We've been told the prices almost never fall and they didn't even fall during that horrible crash. Perfect!

- Our agent gave us some advice but we decided to stay at our rent-stabilized home until we can wait for house prices to go down.

- House prices have gone up 10%, we should have bought the house 4 years ago for half as much. The neighbors are happy and literally swimming in money to the point of them almost quitting their jobs.

- We are finally going to give in and buy a home, we found 1 we LOVE listed at a realistic price for us. We are still nervous about putting the bid in. But our broker tells us that we can use an adjustable mortgage rate.

- In 2007 we caught up with the market, and made a bid on a huge house with no money down and we got it! we're finally owner's of a house.

- Our down payment was wiped out, we owe more on the house than what its wort, the mortgage payment is about to reset and we heard rumors that jobs are gonna start layoffs. How did we get into this mess?!

تم إنشاء أكثر من 30 مليون من القصص المصورة